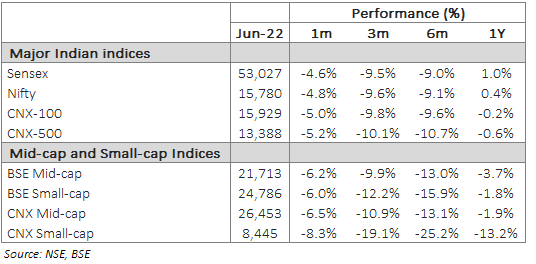

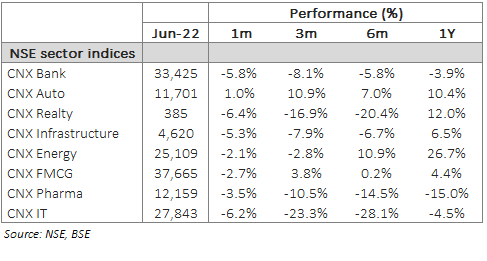

The Nifty corrected sharply 8% in early June before a muted recovery towards the end of the month. We expect continued volatility with muted market returns over the coming 1-2 quarters. A clear direction should emerge only when clarity on a number of macro factors emerge in the coming months. We continue to track these indicators, while following our bottom-up investment strategy, based primarily on earnings growth with adequate guardrails for valuations, balance sheet quality and cash flow conversions.

Interest rates

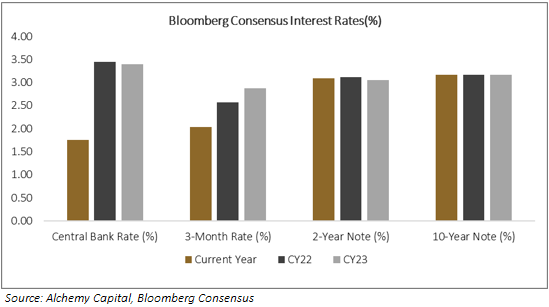

The Fed is expected to raise rates by ~175bp to 3.5% by the end of CY22 before taking a pause. We believe that this is in the price: consensus believes that medium-to-long term market yields have baked this in (see chart below). If the Fed does, indeed, pause at 3.5%, we think that sets the stage for the market to bottom out by the end of CY22 and domestic factors like earnings would then take over as the key driver. It is, however, not a done deal – the Fed’s actions would be governed by inflation trajectory and a pause assumes that there are no further spikes.

The outlook for domestic rates is relatively begin. Consensus expectations are for ~100bp hikes through to FY24, but there is a likelihood that the RBI could pause at 50-75bp from here. There is a little more risk to the long bond yield, given the deficit pressures, but we are closer to peak interest rates than the bottom. As we discussed in previous notes, these hikes take India’s rates to the mid-point of long-term ranges. This poses little risk to the economic recovery, in our view.

Commodity prices

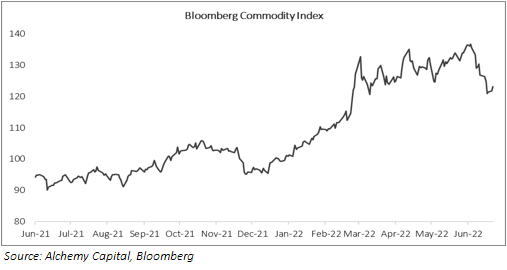

The sharp correction in commodity prices in June is an incremental positive. If it does sustain, it would have a beneficial knock-on impact on inflation, which would encourage central banks to adopt a less aggressive tightening path. We do note, however, that we are entering a period of begin base effect so the correction has to be material for the second-order benefits to kick in. Our base case remains that the Fed tightens in line with consensus expectations.

The ancillary benefit is that this should mean a bottoming out of margins for industries dependent on commodity price input. The lagged price increases are anyway likely to cushion the margin impact from 2HCY22, and a further fall in commodity prices would give the companies extra breathing room.

Earnings

The 1QFY23 earnings season begins in a couple of weeks. Key trends that we will be tracking

- TOPLINE GROWTH: We expect strong growth across the board because of higher selling prices and this being a lockdown-free quarter. For consumer companies, volume growth should remain tepid due to the negative impact of inflation. Overall, we see some tempering of growth from the 4QFY22 levels (23% y/y) due to a stronger base.

- MARGINS: We expect margins to be hurt by (a) the delayed impact of the commodity price spikes and (b) significant wage hikes across most sectors. Companies may offset it with some pullback in discretionary expenses but we do not expect a pretty picture. However, management commentary about the outlook will be important - we think that 1QFY23 is probably the worst in terms of margins.

- CAPITAL ALLOCATION. We think companies should be more careful with capital allocation as the overall environment gets tougher. The cost of capital is incrementally higher because of rising interest rates and falling PE multiples in the listed market. Availability of equity is also not as easy. In this context, we would be more careful with companies that are making aggressive capital allocation decisions in the form of capex or acquisitions.

Overall, we reiterate our view that there is little risk to headline Nifty earnings, as has been demonstrated by the resilience of consensus estimates even after the Ukraine war erupted. The broader market could see a little more pressure, but we do not see any cause for alarm. The upcoming earnings season should give us more insight into this.

Domestic consumer demand

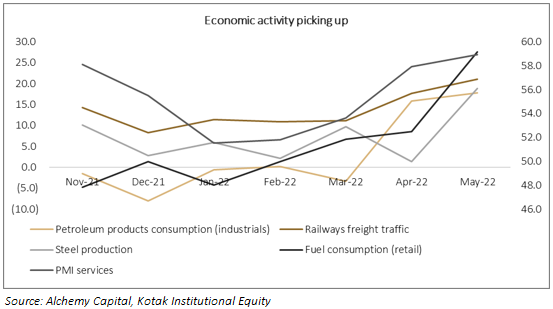

There are strong demand drivers in play for consumer segments across the spectrum.

- We expect a bounce-back in the informal economy (because of no lockdowns) as we progress into FY23. This should flow through to workers in that segment, who make up a large part of India’s low-income population. This should help address the K-shaped recovery problem and help demand recovery in value segments. Inflation, however, remains a challenge but a strong recovery in income may help overcome that.

- Anecdotal evidence indicates that wage hikes for the formal sector (especially in the executive segments) have been strong across most sectors, which has pushed up attrition in many industries. This should translate to a surge in discretionary consumption, despite the inflationary pressures.

- We expect a shift in the composition of consumer demand, as we enter an “opening-up” phase. There has already been a surge in “revenge spending” in areas like travel and tourism, which has seen both improved demand and pricing power. Within consumer goods, we see a tempering of growth in “stay at home” segments like domestic appliances, partly because of a base effect. On the other hand, segments like autos (cars and 2-wheelers) should see a rebound in demand. Moreover, resolution of supply chain challenges in areas like chips should drive improved fulfilment, too.

Staggered deployment continues

We continue to deploy fresh inflows in a staggered manner to take advantage of the continued market volatility. We do not, however, intend to hold cash for extended periods and are trying to invest within a month or so, as far as possible. We continue to focus on companies with earnings growth, as that should be the key driver of stock prices in a rising rate environment. We are constructive on IT, manufacturing, automotive, chemicals, pharma and high contact sectors like retail and hospitality.

Seshadri Sen

Head of Research

Alchemy Capital Management Pvt. Ltd.