Nov 2022

If you find this read interesting, share it on:

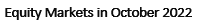

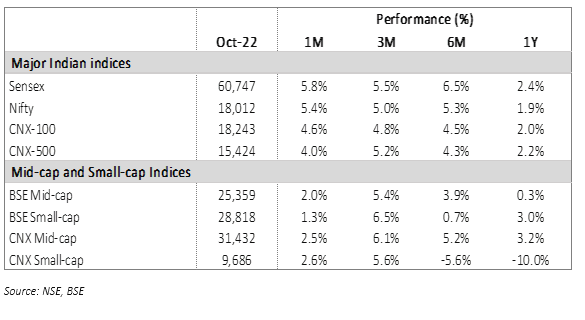

The markets saw a strong Oct-22 with large cap indices leading the charge. Banks and IT led the charge with significant outperformance. Hawkish commentary from the Fed has popped up as a speed-breaker in early Nov-22 and could put some dampener on near-term performance. The earning season saw strong topline growth but margin pressures for non-financials dented PAT growth.

We remain constructive on the markets. The rate cycle, both in the US and India, is nearing its peak and will cease to be part of the conversation from CY24, in our view. On the other hand, we see positive momentum from domestic demand and a sustained multi-year revival in the industrial sector. We continue to minimise cash levels and aim to deploy fresh inflows within a month, in most cases. We recommend investors stay fully invested to the extent of their equity asset allocation. Lumpsum investments can be staggered over some time, but we would advise against holding back for more than 1-2 quarters.

Fed Rate Hikes

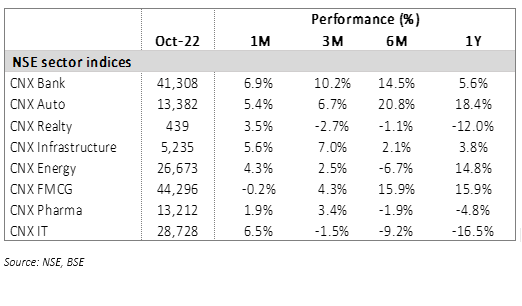

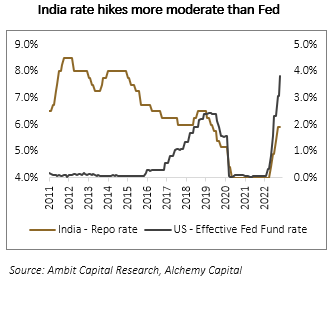

The markets were disappointed with the Fed Chairman’s statements after the latest FOMC meeting. This is, incrementally, a negative but the bigger picture is that we are closer to the end of the rate hike cycle than the beginning. We believe the impact on India will be muted and transient for three reasons:

► Much of the FII selling on the back of Fed tightening (rate hikes + balance sheet reduction) pre-empted the hikes. Going forward, there may be some additional selling but it is unlikely to be in the same magnitude as in 1HCY22. The now-extended period of Fed hikes may be a dampener for incremental buying, but we think the market can cope with that.

► The contagion to India will be less impactful. We believe that the RBI will pause its rate hike cycle in late CY22 or early CY23, with a peak rate of around 5.5%. This is the mid-range of India’s historical rate cycles and is unlikely to significantly dampen demand or hurt borrower balance sheets.

► There could be some pressure on the rupee in the short term, but that, too, would be transient. We do not envisage a scenario where the rupee comes under so much pressure that it destabilises financial conditions in India’s domestic market. Muted incremental FII selling and relatively narrow interest rate differentials underpin our confidence.

Strong Festive Season

Consumption demand through the festive season remained strong, despite high inflation and relatively higher interest rates. There were a few interesting facets to this

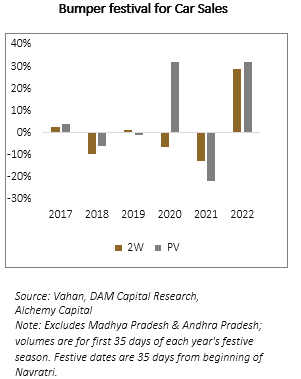

► Auto sales have rebounded strongly, with supply chain challenges waning and underlying demand coming through. This is despite multiple challenges: rising fuel and ownership costs, higher prices/reduced discounting, and higher interest rates. Interestingly, demand is stronger in the slightly premium categories.

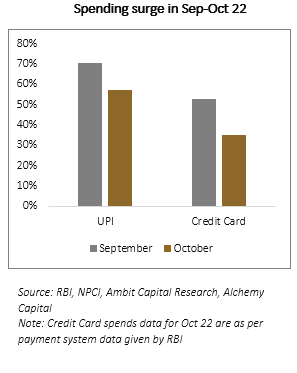

► The festival sales promotion campaigns by e-commerce companies have been hugely successful in the last week of Sep-22. According to anecdotal data, mobiles and white goods saw a massive surge in sales during this period. There were worries that demand in these categories had been front-ended during the Covid period, but there does not seem to be any signs of abatement.

► Credit card transactions showed a massive rebound in this period, indicating a surge in high ticket spending. Despite such high growth, cards continued to lose market share to UPI – indicating that underlying demand has been very powerful through this period.

We see this as a sustained period of high consumption growth in India driven by rising per capita income driving aspirations and affordability. In the short term, we see the upcoming wedding season further fuel demand in certain categories (like jewellery) but the medium-term outlook remains constructive.

Key Sectors

We see three key sectors that would impact the indices in the coming 2-3 quarters. We remain constructive on all three, but believe that opportunities for most of these sectors would lie in non-index stocks, going down the market cap curve.

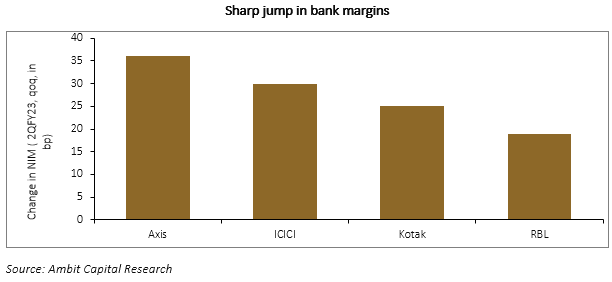

► Financials. Bank results were exceptionally strong. The sharp hikes in repo rates led to a front-ended jump in loan yields, driving margins up. Some of these gains will be lost in FY24 as deposit pricing catches up, but changes in loan mix towards unsecured lending will partly help cushion this. Banks are also enjoying a golden period in asset quality, and we see further cuts in provisioning forecasts by the street. Our approach to the sector is selective – we see outperformance opportunities in relatively cheaper stocks that have rerating potential, rather than expensive stocks that are dependent purely on earnings compounding for future returns.

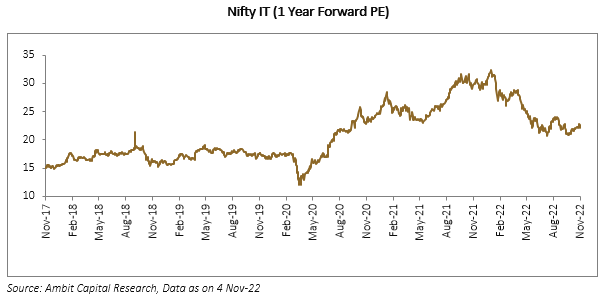

► Information Technology. The sector is undoubtedly facing headwinds – coming off a high post-Covid base and now will have to deal with an imminent slowdown/recession in Europe and the USA. On the other hand, the sector PE has also derated significantly during the year as it faced the brunt of selling in 1HCY22, partly driven by the derating of tech stocks in the USA. We think the correction has made the sector reasonably valued and attractive from a medium-term perspective, even if the short-term outlook may be uncertain.

► Industrials. We see a long multi-year growth runway for industrials (capital goods, infra, auto ancillaries). Demand is returning as the capex cycle starts to slowly revive, aided by both government and private spending. Global supply-chain realignments add to the demand tailwinds, with policy support from the Indian government. The companies who have survived the “lost decade” of 2011-2020 are now able to exploit this new growth cycle. There are some pockets of stretched valuations, but the strong multi-year growth outlook gives us confidence in this sector, and we continue to look for fresh ideas in this space.

Results Summary

Margin hits dilute topline growth

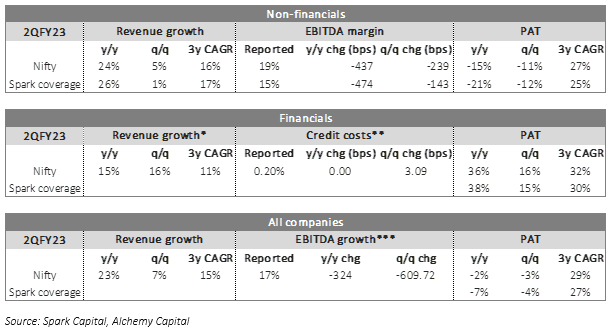

We are more than halfway through the earning season. Here are some of the key takeaways:

► For non-financials, PAT growth has been weak – a small contraction in aggregate. This was, however, largely expected as there are some temporary factors that have driven this outcome.

► Topline growth was robust for non-financials. Revenue growth was 24% y/y – even the three-year CAGR (which smoothens out the Covid-era base effects) is strong at 16%. This is a sign that demand growth across segments – both consumer and industrial – is on an upswing. Our constructive thesis on the markets is largely based on this trend.

► Margins contracted significantly due to RM pressures from rising commodity prices. We are closer to the end of that cycle and expect margins to recover from CY22 as price hikes get passed on to the end-users. Also, commodity prices are stabilising so incremental pressure on RM prices should abate.

► As discussed above, bank results were strong and offset the weak numbers from non-financials. We expect this trend to continue, though FY24 could see some pressure on margins.

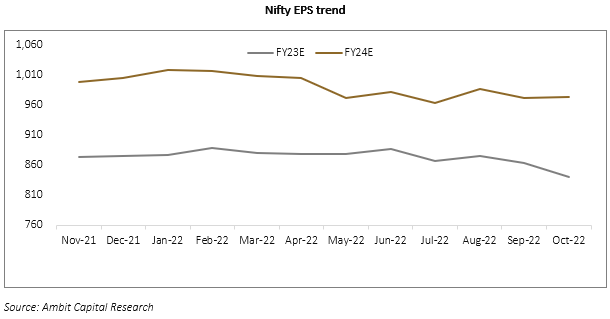

► The impact on earnings forecasts has been minimal. FY24 consensus Nifty EPS was stable through Oct- 22 (refer chart below) and is down a mere 4% from Jan-22. As margins rebound, we see an upside to consensus forecasts from current levels.

Seshadri Sen

Head of Research

Alchemy Capital Management Pvt. Ltd.