Jul 2023

If you find this read interesting, share it on:

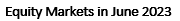

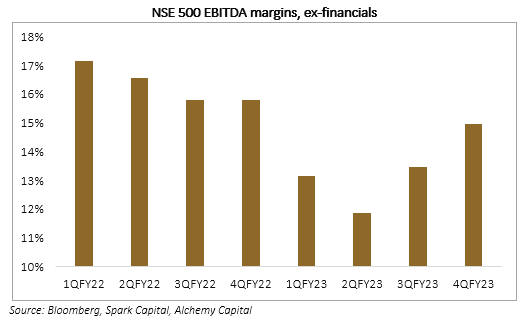

The market momentum continued into Jun-23 with a strong broad-based performance. Small and mid-caps outperformed with capital goods, auto ancillaries and defence emerging as some of the strongest sectors. The Nifty also touched a new high. Despite the strong rally, the broader markets remain reasonably valued (Nifty at 18.7 1yr forward PE) and we believe that we are in the middle of a secular bull run. There are some risks of a short-term correction, but we should use any such weakness to increase exposure to Indian equities.

1QFY24 Results Outlook

Another earnings season is upon us: We look at some key trends that we are tracking.

- We expect industrials to deliver strong topline growth which should flow into improved margins, especially in a benign commodity price environment. The commentary from most managements has been positive and there is significant momentum in the domestic capital goods cycle. The sub-sectors that we are particularly constructive about are defence, capital goods and auto ancillaries Some of this has been discounted in the strong rally for these sectors in the last 3-4 months, but we do not see much risk of earnings disappointments. The next leg of the rally could be driven by disclosures on order inflows and growth outlook from the managements.

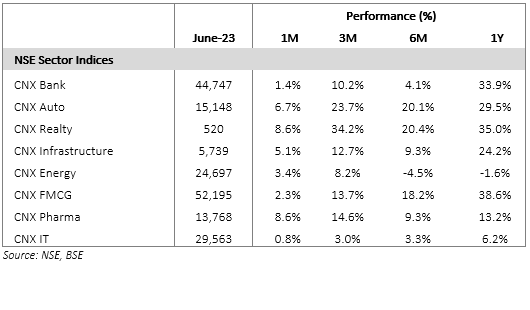

- EBITDA margins for non-financials have corrected sharply since CY22 due to the commodity price rally. This has started to unwind now and there was some improvement in 4QFY23. We think this story is yet to fully play out and we expect 1QFY24 results to reflect further momentum on this front. The drivers would be threefold: the correction in commodity prices, price hikes taken by companies across sectors and operating leverage for industrials that are delivering strong growth.

- We expect a discordant note from discretionary consumption companies. Growth appears to have been weak across multiple categories, driven by a high base, consumer fatigue and, in our view, a slight softness in consumer confidence given the weak jobs outlook in the tech sector. Companies are expecting a recovery from 2QFY24 as the build-up to the festival season begins, but there is no evidence of that playing out yet.

- Net interest margins (NIMs) for banks have been on a tear through FY23 (see chart below). This seems to be primarily driven by the instant repricing of mortgage loans due to the transition to external benchmarking a few years ago. Now that the RBI has paused on policy rates, margins should peak and come off on a quarterly sequential basis as deposits continue to reprice upwards. This will be a key monitorable for the sector – while the downward direction of NIMs is largely built into expectations, any surprise on the quantum could impact stock prices disproportionately.

- IT sector results will be closely watched. The sector was a major underperformer in FY23 and has started to claw back, mainly on valuations and expectations that growth shock from the US slowdown may be less severe than expected. The latter assumption will be tested in this earnings season, both from actual numbers delivered and management commentary.

Market Outlook – Near Term

We remain constructive on the market for the medium term, but there may be some issues and risks in the next 1-2 quarters that we need to watch out for.

- Valuations of industrial companies are a slight worry. We recognise that they are in the middle of a strong cycle but B2B companies have limited upside in profitability (ROE/ROCE) and need to keep investing to sustain growth. This limits free cash flows and also leads to volatility. The rich valuations could lead to higher volatility in the stocks and/or time correction. We remain constructive on the space but are wary of excess exposure to expensive stocks.

- There has been very little sector rotation in this rally – it has been mainly led by industrials (capital goods, auto ancillaries and defence) with financials and consumption lagging. This is in line with fundamentals where industrials have a stronger earnings momentum behind them (both growth and revisions). However, as relative valuations polarise, there could be temporary spells of mean reversion where financials and consumer stocks could come back in favour of short spells.

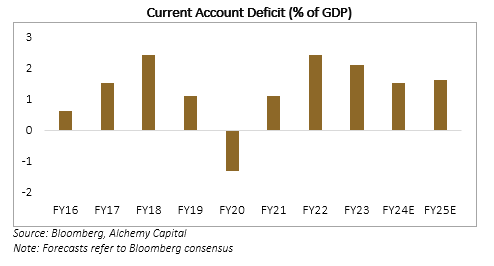

- India’s external account continued to be resilient. The small negative surprise in 4QFY23 was a blip – the overall current account deficit is benign at 2% of GDP for FY23 and Bloomberg consensus expects a further improvement to 1.5% in FY24, well below long-term trends. The key risks are oil prices or a risk-off in global assets which may affect FDI/FPI flows. We do not see any risks emanating from the rupee at this stage, but it is a variable that should be closely tracked.

In summary, there is a risk of a correction in the near-term, or at least a period of sideways movement. We do not see that as a major worry. The medium-term outlook for the markets remains positive, driven by sustained growth and robust, broad-based earnings momentum. Any corrections should be used to increase exposure to equities.

Seshadri Sen

Head of Research

Alchemy Capital Management Pvt. Ltd.