The Indian rupee dropped sharply in July 2022, down 1.5% despite the strong end-of-month rally. We see however, no cause for alarm, as this is a relatively small slide compared to historical incidents, and the major headwinds seem to be dissipating. The markets and the economy should be able to absorb this. It is a tail risk, however, that we are keeping our eyes on, as it has a relatively high correlation with the equity markets. We also do not expect any knee-jerk reaction from the RBI, and we think that they will raise rates by ~100bp by the year-end, including a steep hike on August 5th. The tightening by the RBI is unlikely to destabilise growth.

Impact on markets

- Currency movements impact the equity markets at multiple levels. There is a flow-through to earnings (discussed later in the blog), but it also affects domestic interest rates and foreign capital flows. The relationship between currency and flows/rates is complex and circular (cause and effect are hard to discern) but the net impact on equities is significant. As chart below shows, the currency has the highest correlation with equity markets among the major macro indicators.

- Empirical observations show that sharp sell-offs in the currency are usually accompanied by some weakness in the markets. There is a lead lag, but the correlation is fairly clear. The biggest reason is FII flows – which is both a cause and partly an effect of a weakening currency. From our perspective as equity investors, it is therefore important to track the rupee market as it poses an extraneous risk for the broader markets.

- We are not worried this time for two reasons: First, the currency sell-off is relatively mild compared to past episodes. Second, the markets had already sold off in 1HCY22– we have observed that there is a lead lag factor so the risks are now compressed. Chart above, however, is also a warning - if the currency weakens further from here, we could see fresh risks emerge for equities.

Key drivers of the rupee

- The biggest source of weakness is the tightening by the US Fed. The Fed funds rate has already been raised by 225bps in CY22 and consensus expectations are of a further increase by end of the year. The RBI has raised rates but is unlikely to keep pace with the Fed, causing the rate differentials to probably widen further. This will cause additional pressure on the currency, but we do not think it is the clinching factor. The predominance of equity in India’s external capital flows (55% from FY18-FY22) helps cushion the currency from being ultra-sensitive to rate differentials.

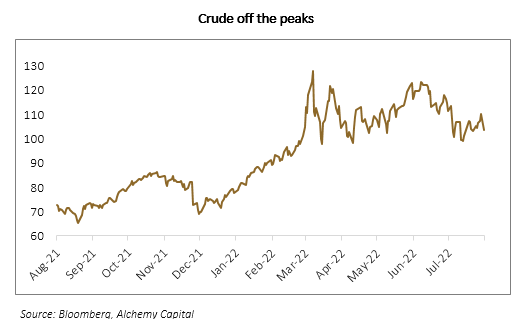

- Crude prices have corrected 36% from the highs of early March, giving some relief to India’s potential current account deficit. This is an important determinant, as India is dependent on imported energy and a spike in crude prices directly impacts the CAD and the currency. The recent correction has taken the pressure off, but the outlook remains uncertain, and this remains a risk to the rupee and the equity markets.

- 1HCY22 was one of the largest equity sell-offs by FPIs in the Indian market - $28.5bn, unwinding almost two years’ net purchases. Given India’s dependency on equity capital flows, the depreciation of the rupee could have been much worse. Going forward, we believe that the selling should slow down as the large part of the portfolio adjustment is probably done. This would, in our view, ease the pressure on the currency.

- We expect economic growth to remain strong for India as the impact of “opening up” and the rebound in the informal economy drives the momentum. Indian consumption, unfortunately, remains import-intensive and could put some pressure on the current account deficit.

Our base case view is that the worst is over for the rupee and 2HCY22 should be easier for the currency. However, risks remain if either crude prices spike from here and/or the Fed tightens beyond market expectations. The rupee has been remarkably resilient in the past 6 months, largely due to support from the RBI. If the fundamentals weaken from here, the RBI will find it more difficult to defend the currency. We, therefore, remain vigilant on the low-probability likelihood of a sudden slide in the rupee and the contagion effect on the equity markets.

Impact on earnings

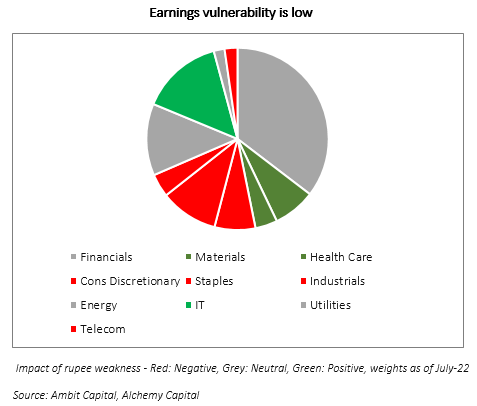

Rupee depreciation has a net negative impact on the broader earnings basket, in our view. For a relatively small move such as the recent one, the drag is relatively small and it is also a asymmetrical across sectors.

- Exports are, obviously, positively impacted and the IT sector is amongst the biggest beneficiary. The flow-through is, however, not linear as there are some cross-currency headwinds that can dampen the benefits. Companies also have different hedging policies so the gains are sometimes harvested with a lag.

- The depreciation has a negative impact on margins for most consumer and manufacturing companies. Domestic-facing companies have no natural hedges against imported raw materials (RM), so a weak rupee leaves them vulnerable. In this cycle, however, the rupee played a bit part – the spike in underlying RM prices was a bigger culprit in dragging down margins. If global commodities correct from here on, the weak rupee will not hurt the importers much.

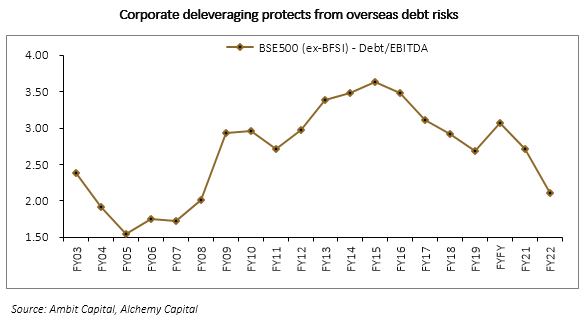

- There have been some worries raised on the large stock of external private sector debt, much of which could be unhedged. We do not see any cause for alarm yet: the slip in the rupee is relatively small; many of the borrowers have natural hedges and overall leverage for Indian corporates is under control. We also think that a large portion of this debt lies outside the listed universe – the risks, if any, lie at the macro level and would not impact listed market earnings.

Domestic interest rates

The pressure on the currency does have a significant impact on domestic monetary policy. We wrote a detailed May 2022 blog on how we see interest rates play out and its impact on the economy: TL;DR is that we are not worried. The following is a summary of our thoughts:

- RBI is not done raising rates and we expect hikes through to the end of the year. We expect the RBI to largely be in line with consensus expectations of a 100bp hike by end of FY23 with a possibility of further front-loading.

- This is still slower than the Fed hikes but we think the RBI will not follow in lockstep. If the risk factors we discussed (crude, faster fed hikes) do materialise, a direct intervention would work better than further rate hikes.

- The terminal repo rate of ~6% is unlikely to create any material risks to growth or corporate profitability. We see this as a normalisation of the Covid stimulus and are not worried about its impact.

Earnings trends

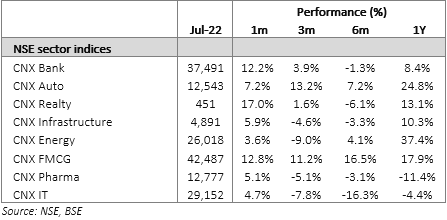

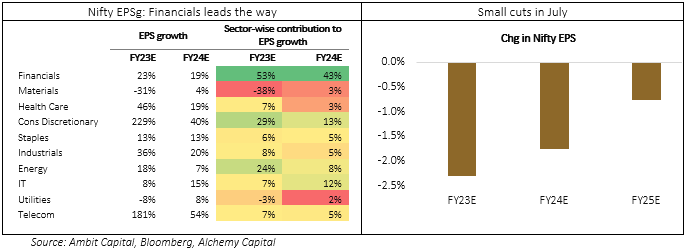

Consensus earnings have seen 1-2% downgrades through July. However, the overall expectations are of ~15% growth through FY23/FY24 – making it a rare instance of three successive years of double-digit EPSg for the Nifty. The market looked through the downgrades as we entered July on the back of a weak six months and the cuts are relatively minor. Financials is the key driver of this elevated growth, making up almost half the EPSg over the next two years. Healthcare and consumer discretionary are the other high-growth sectors, but with relatively lower index weights.

Our view

We are constructive on the markets over the medium-term (3-4 quarters) but believe that there could be some short-term volatility, despite the strength in the markets in July. We are in stock-picking mode and continue to “follow the earnings” rather than play a broad market recovery. We believe that off-index stocks are more likely to deliver and are focusing on ideas along those lines, with suitable risk guardrails. Our deployment strategy remains cautious, and we are staggering fresh inflows over time to take advantage of market fluctuations. In most cases, we aim to deploy inflows over 30 days.

Seshadri Sen

Head of Research

Alchemy Capital Management Pvt. Ltd.