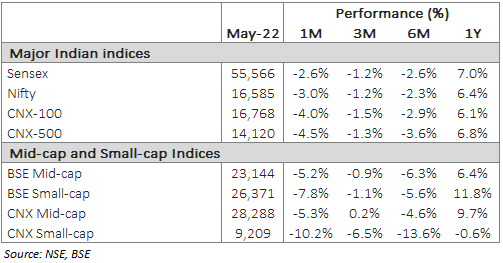

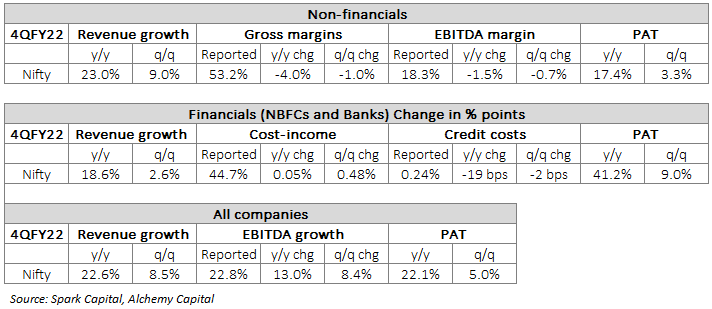

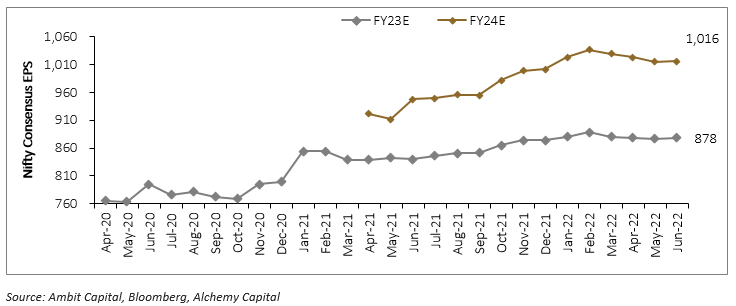

India’s corporate earnings stayed resilient through the multiple shocks in early CY22. 4QFY22 earnings were strong with 22% PAT growth for the Nifty, driven by resilient margins despite the external shocks. More importantly, consensus estimates for FY23 and FY24 have stayed stable. We believe that this underpins the upward trajectory of the broader market in the medium term. In the short term, however, rising rates, elevated inflation and domestic consumption trends will rule, and keep the markets volatile.

4QFY22 earnings – key thoughts

- The quarter took a couple of lumpy hits – Omicron at the beginning which led to some partial shutdowns and the Ukraine war which caused a spike in commodity prices towards the end

- Non-financials: Topline growth was strong, but margins took a hit due to commodity prices, in the main. Some of the gross margin stress was mitigated in fixed costs leading to lower stress at the EBITDA level. PAT growth was at 17%, despite all the pain.

- Financials: Revenue growth is recovering as the economy opens up, as is evident from other data like credit card spends. Credit costs were sharply down but could still fall further as Covid-related stress washes out and the benefits of the last three years’ risk aversion accrue

- Aggregate: Revenue growth of 23% YOY and PAT growth of 18% YOY is a strong outcome, despite the stresses of the Omicron and Ukraine war. The margin pressures may continue into 1QFY23, but price hikes would take over from there.

Strong earnings outlook

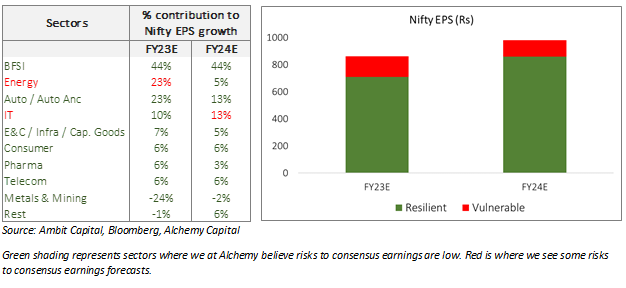

The macro headwinds have not shaken the earnings outlook for the Nifty. Consensus estimates for FY23/FY24 have stabilised after the first round of cuts, following the Ukraine invasion. Our sector-wise earnings analysis gives us confidence that these numbers have limited downside risk. Chart 1 below gives us the sector-wise earnings growth and the contribution to Nifty EPS growth. Apart from IT and Energy, we see little risk to the forecasts for most other sectors.

Financials. BFSI earnings are heading for a golden spell over the next two-three years. Credit costs should remain ultra-soft as banks a) recover from the credit shocks of asset quality review and Covid and b) harvest the benefit from being risk-off for 4-5 years. In addition, revenue drivers should kick in as loan growth recovers and fee income bounces back as the economy opens up. We see little downside risk to these consensus forecasts through this cycle.

Auto: This is another sector that is coming out of a long winter. Successive regulatory shocks were compounded by the headwinds from covid that finally culminated in the chip shortage. Over the next 2-3 years, we expect demand to recover and margin pressures to ease – moreover, competitive pressures should peak as the strong companies benefit from survivorship bias. there appears to be little to no vulnerability to these forecasts.

E&C/Infra/Cap Goods benefit from the changing policy environment. There are multiple drivers to the capex cycle in play – government spending, PLIs, recovery in private demand – and should keep earnings growth elevated. Moreover, the sector is more resilient to inflation as it generally operates on a cost pass-through basis.

Consumer earnings are driven by two factors. We expect demand to recover in FY23 on the back of opening-up and the strong agri sector. As incomes recover at the bottom of the pyramid, the headwinds from inflation should ease and consumption demand would start to come back. Moreover, the worst of input price pressures are over, and the companies would continue their calibrated price hikes to bring back margins.

Pharma/Telecom: The growth is driven by turnarounds in Sun Pharma and Bharti, driven by individual company factors and less by macro factors. There is very little risk to these.

Metals and mining: Consensus estimates have already factored in a sharp decline in realisations over FY23, and stabilisation thereafter. Spot prices are still running ahead of the consensus numbers, so there is little scope for further downgrades.

Oil and Gas: is one of the most vulnerable sectors in this universe. The estimates depend on the stickiness of global oil prices, which could unwind if the Ukraine invasion is peacefully resolved. There would be a second-order positive impact on other sectors that would mitigate some of the demand, but this remains the main point of vulnerability to consensus estimates.

Information technology: This sector could see some volatility in forecasts. As the narrative around a US recession gathers strength, analysts may turn jittery and downgrade forecasts for FY24. We believe that the sector is seeing structural tailwinds and may not necessarily be vulnerable to a US slowdown, but consensus estimates could still be vulnerable in the coming quarters.

Sectoral composition of Nifty EPS

Short-term factors

The earnings resilience is a source of comfort, but it would play out over a longer period. In the short term, however, the markets would be governed by factors other than quarterly results, and this could lead to continued volatility.

- Interest rates in India and the US will be an important factor. We believe the RBI will continue to tighten through CY22 and take the repo rate back to pre-Covid levels, at least. The Fed, too, is likely to raise rates and tighten liquidity significantly, probably well into CY23. Some of this has already been priced into the markets, but we do not rule out continued volatility for some more quarters.

- Inflation remains elevated and the second-order effects (wages, inflationary expectations) are starting to become visible. The good news is that a large part of this is supply-driven and could easily unwind as quickly as it manifested. Until that happens, however, it will remain a source of worry for governments, central bankers, company managements and investors.

- Consumption recovery is key to sustaining the earnings momentum across most sectors. We believe that the rebound in unorganised-sector employment and strong wage inflation will help the consumer overcome the headwinds of inflation as we head deeper into FY23. A strong agri economy should also help. The market will track evidence of this as we head towards the festival season in 3-4 months from now and it will determine the short-term outlook for Indian equities.

Slowing deployment, but still minimising cash

We are deploying new cash in a staggered manner to take advantage of the recent volatility. We intend to, however, deploy within a reasonable period and do not plan to meaningfully increase our cash position. For stock-picking, we continue to “follow the earnings”, with obvious filters for valuation and quality. We are positive on IT, manufacturing, automotive, chemicals and pharma and high contact sectors like retail and hospitality.

Seshadri Sen

Head of Research

Alchemy Capital Management Pvt. Ltd.