Dec 2023

If you find this read interesting, share it on:

In chapter 5 of the Bhagavad Gita, Shree Krishna compares Karm Ssanyās Yog (the path of renunciation of actions) with Karmyog (the path of work in devotion).

He says: We can choose either of the two paths, as both lead to the same destination. However, he explains that the renunciation of actions is rather challenging and can only be performed flawlessly by those whose minds are adequately pure. Purification of the mind can be achieved only by working in devotion. Therefore, Karmyog is a more appropriate path for the majority of humankind. The Karm Yogis with a purified intellect perform their worldly duties without any attachment to its fruit.

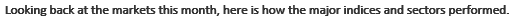

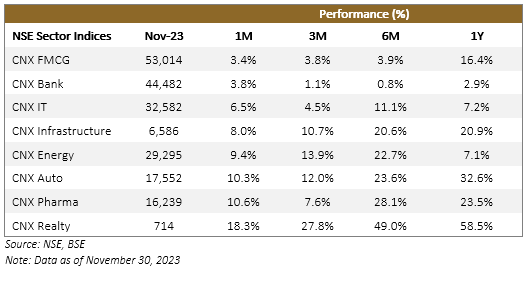

Q2FY24 was the exact opposite of Q2FY23. Last year in Q2FY23 we had margin compression and negative operating leverage. We have seen margins bounce back in Q2FY24 and a positive operating leverage. Also, with the festive season in Q3FY24, we should see strong traction in topline and profits especially for consumer-oriented companies and autos in the upcoming results.

With Markets at new highs, the most relevant question would be are the markets overvalued? Are the valuations expensive? Indian markets have already run up so much, is there room for more?

Here’s our understanding of the same.

We have been consistently saying that the markets are following earnings growth. On earnings growth therefore the markets don’t look that expensive. If we look at the broader Nifty 500 companies Adjusted PAT has grown ~175%. However, the Nifty 500 has moved only ~90% between FY19-FY24E. Thus, we believe that the broader markets have not run ahead of the earnings, it is still lagging in earnings and there is some room for catch-up.

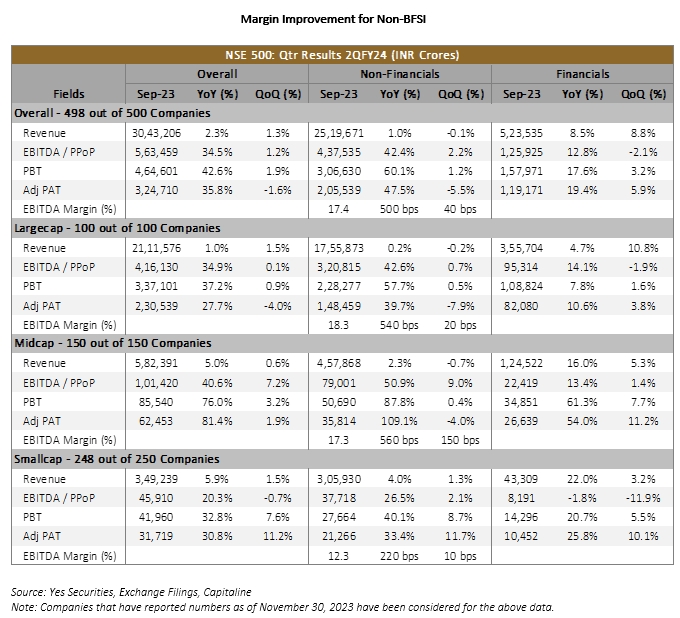

In fact, even if one looks at India vs US Market cap to GDP, India Market cap to GDP is 119% vs peak at 157% and US Market cap to GDP is 175%.

This is because the Nifty index has broadly followed the trends in GDP and Nifty EPS over the last 20 years.

However, the Largecaps seem to be more attractive here as:

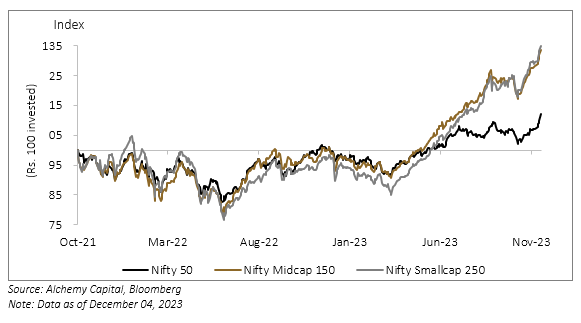

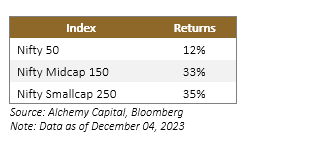

1. If we were to look at the Nifty returns since the last high in October 2021, Mid and Smallcaps have outperformed.

2. If we were to compare the valuations, Largecaps are still around their last 5-year average while small and midcaps are slightly above their 5-year averages. However, compared to October’ 2021 in spite of the price move, the valuations haven’t changed much because the denominator being earnings has been robust across the board.

Getting back to the Bhagavad Gita, why does Shri Krishna emphasize knowledge so much? There is always one aspect of our lives that is incomplete or imperfect. For some of us, it could be our job. For others, it could be our family and friends. For some others, it could be our health. Given these various imperfections, we try to better our situation by changing our jobs, friends and so on. This results in a roller coaster ride of joys and sorrows. But if we take a truly objective look at this situation, it turns out that we are looking for perfection in the material world, which will always be imperfect.

Himani Shah

SVP – Investments & Research

Alchemy Capital Management Pvt. Ltd.

Disclaimer: Investments are subject to market risks, please read all product /strategy related documents carefully before investing.