Dec 2022

If you find this read interesting, share it on:

The Nifty touched a new lifetime high on 1-Dec-22 and we see a breakout from here on the broader indices. The stars seem to be aligning for equities as headwinds from the synchronous global tightening dissipate over the next 2-3 quarters. On the other hand, we believe that the domestic economy remains strong with both consumption and investments starting to fire. We see a multi-year earnings growth cycle and the richly valued markets reflect that. Our preference is for mid-caps and cyclicals, and we are keeping an eye on the valuations of the stocks where we are building positions. We advise investors to remain fully invested and avoid aggressive cash calls at this point in the cycle.

The Changing Global Scenario

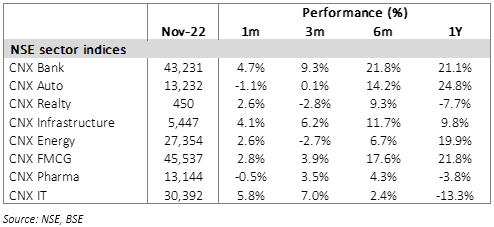

The big positive is that we expect global financial conditions to be more stable in the coming quarters. The rate cycle may peak in early CY23, with some lead-lag across countries depending on inflation data. Consequently, the sharp appreciation in the global dollar index (DXY) should also stabilise. A repetition of the sharp FPI selloff of 1HCY22 is, thus, unlikely and should create favourable conditions for the Indian equity markets. The only near-term risk is a recovery in the China markets that could divert flows away from India – this, however, will be less disruptive than the dislocation of early 2022.

The global challenges shift, however, from the financial to the real economy. Investors should prepare for a significant slowdown in the US and Europe, which could lead to some stress for both manufacturing and service exporters. There are three mitigants, however

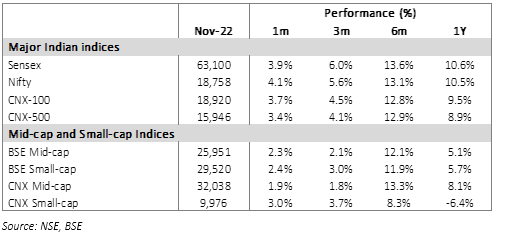

1. Stock prices for one of the biggest export sector, information technology, have already priced this in. The NSE IT Index has underperformed the Nifty by 30% in CY22 and the froth in forward valuations has already melted. Earnings revisions have also been downgraded for many export-oriented sectors.

2. We think the slowdown should help ease global commodity prices. Oil prices are already flat over the last 5 months and a recession/slowdown in the West would put pressure, supply cuts notwithstanding. This helps India’s macro as well as eases some of the acute margin pressures.

3. Global supply chain diversification should help India through the slowdown. India has been helped by global producers prioritising the need to reduce dependence on a single country (mainly China) after the supply chain disruption in the post-Covid world. In our view, this is a structural driver of Indian exports that should partly soften the impact of a Western-world recession.

Key Domestic Drivers

• We see strong consumer demand through the next 2-3 years. The bounce in consumption in FY23 is not just a one-time post-Covid event. Rising per-capita income and aspiration levels should continue to fuel demand and premiumisation trends across the discretionary space. The growth in FY24, however, may be tempered by the high base effect in FY23.

• We remain constructive (pun intended!) on the capital spending cycle in India. This has been led by public spending, which should continue strongly given the comfortable state of India’s finances and the impending election cycle leading up to the national vote in 2024. We see a multi-year growth cycle for capital goods and infra companies.

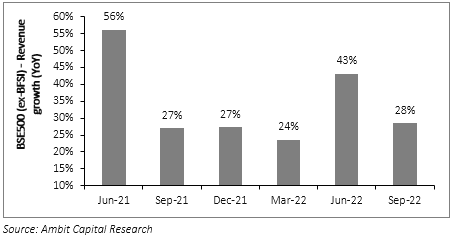

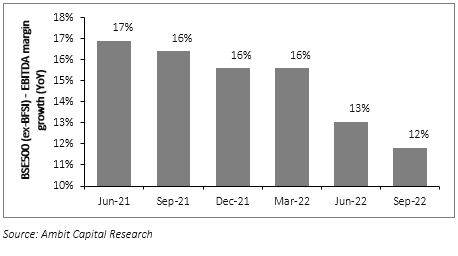

• We see margins having bottomed out in 2QFY23 with a massive drop in EBITDA margins. Going forward, commodity prices could peak, and companies could start clawing back some benefits from price hikes. Other cost pressures like wages are also starting to ease, at the margin.

Key Market Trends

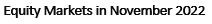

We remain positive on the equity markets and see a breakout after a year of struggle, especially after the market made a new lifetime high on 01-Dec-22. We see three clear trends in the market internals

1. Midcaps have been relatively weaker than large-caps since Sep-22, as the broader market corrected. We see that reversing and expect mid-caps to significantly outperform from a 2-3 year perspective, for two reasons: a) We see a broad-based economic recovery which should incrementally benefit mid-caps a little more and b) most large-cap stocks are priced to perfection and have little more to offer than earnings compounding. Of course, there are pockets of overvaluation in the mid-caps (reflected in more expensive indices), so we are being selective in the stocks we buy.

2. We see cyclicals outperforming defensives in the next rally. This is not just at a sector level, where we expect sectors like industrials to lead the market over the next 2-3 years. We also expect that intra-sector outperformance will be driven by the more cyclical names – a prime example is financials, where banks that were perceived to be weaker are outperforming the Bank Nifty.

3. Market valuations are elevated, though with good reason. We are amid a multi-year earnings growth cycle with strong balance sheets and limited risk – the market is pricing that in. The implication is, however, that stocks with relatively lower valuations are likely to outperform in this scenario. Within our overall framework of “growth at reasonable price (GARP)”, we will focus on stocks with re-rating potential in our hunt for outperformance.

Quick Take: RBI Rate Hike

- The RBI’s monetary policy committee voted to raise the repo rate by 35bps on 7-Dec-22. This was largely on expected lines. The reiteration of its hawkish stance on liquidity was a slight disappointment, though.

- We believe that we are near the end of the tightening cycle. We do not expect rates to go up by more than 25bps from here and 1QCY23 should see peak interest rates. Liquidity will steadily tighten but we do not see any cause for alarm or any major liquidity-driven accidents. Financial conditions should remain stable.

- Banks will face deposit growth challenges over the next 2-3 quarters, as loan demand continues strongly, and liquidity remains tight. The NIM improvement in 2QFY23 may last for another quarter but deposit repricing will then start putting pressure on margins. Lasting NIM improvement will come mainly from changes in the loan mix.

- We do not think that the rate hikes and liquidity tightening will destabilise growth. The peak rate in this cycle is much lower than historical peaks. The level of liquidity tightness is not acute enough to impact aggregate demand, in our view.

Seshadri Sen

Head of Research

Alchemy Capital Management Pvt. Ltd.