Aug 2024

If you find this read interesting, share it on:

Nifty 50 gained 3.9% in July 2024, led by strong data from the FMCG and IT sectors, where some signs of rural recovery are beginning to emerge. Energy prices stayed high, but banks disappointed in terms of growth in deposits and showed some systemic stress. Overall, it is not too bad of a showing, in our view. Amid fears of a US recession, crude fell by nearly 7%* (Source: Bloomberg). A few corrections were made as a result of the numerous changes in capital gains tax across asset class made in the Union Budget 2024.

Macro

-

The International Monetary Fund (IMF) upgraded its growth estimate for India from 6.8% to 7% for 2024–2025 due to an improvement in private consumption, especially in the country's rural areas. In April 2024, the IMF had revised its prediction for India's GDP growth from 6.5% to 6.8%.

-

The Finance Minister presented the budget, announcing a reduction in customs duties on gold, silver, mobile phones, and other goods in addition to raising SD and changing tax rates for salaried individuals under the new tax system. The key positive of the Budget was fiscal consolidation. One of the dampeners was the increase in capital gains tax rates and the removal of indexation benefit on the real estate capital gains (subsequently proposed to be grandfathered).

-

From 4.80% in May 2024 to 5.08% in June 2024, India's CPI (Consumer Price Index) increased to a 4-month high. (Source: https://cpi.mospi.gov.in) India's WPI (Wholesale Price Index) jumped to a 16-month high of 3.36% in June 2024. (Source: Ministry of Commerce & Industry)

-

The central and state governments collected ₹1.82 trillion in GST in July 2024, marking a 10.3% year-on-year increase. (Source: Finance Ministry Data)

Q1FY25 Results So Far

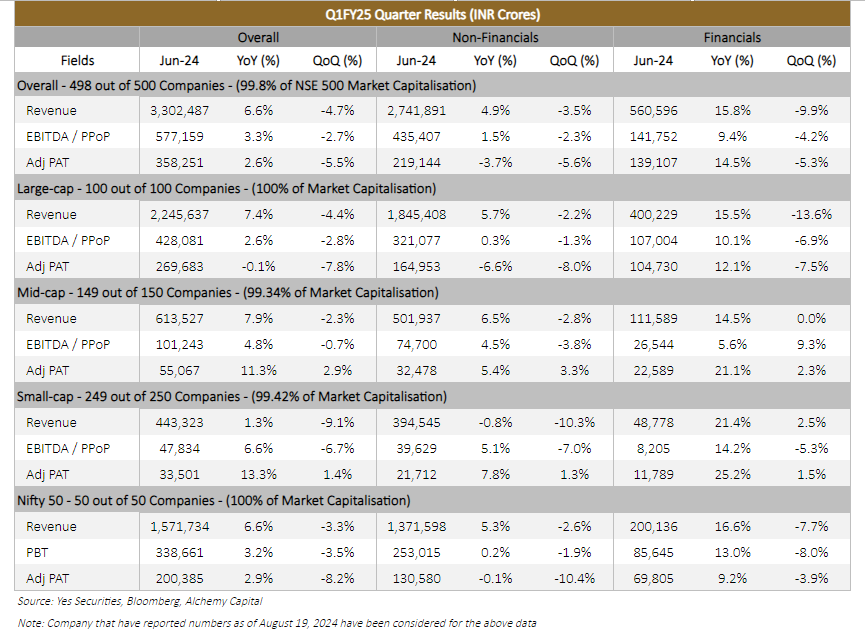

The first quarter earnings season for fiscal year 2025 (Q1FY25) is over. The financial results were quite lacklustre. The overall data from the Nifty 500 Index shows a year-over-year (YoY) revenue growth of 6.6%, an operating profit increase of 3.3% YoY, and a net profit rise of 2.6% YoY.

Why are we so underweight on financials, especially in private banks & retail NBFCs?

Interestingly, the financial sector has shown a notable 14.5% YoY profit growth, significantly outpacing the 2.6% YoY growth of the entire universe. This trend is consistent across Nifty 50, Midcap, Small Cap, and Large Cap stocks.

Despite these positive figures, the sector has not performed well in the stock market, sparking intense debate within the sector. The market's largest sector by weight is divided in opinion. Some see this as an asymmetric response, akin to irrational exuberance in other areas of the market, while others are trying to identify new market leaders. The reality might lie somewhere in between.

Several potential incremental challenges for banks include:

-

Lower Net Interest Margins (NIMs)

-

Higher credit costs

-

Deposit growth issues

While these negative factors could be real, consensus estimates seem to have accounted for lower NIMs from extremely high levels and higher credit costs from the low levels seen in the second half of FY23 and the first half of FY24. The main focus remains on gradual progressions. The issue of deposits is more complex, with low growth in CASA deposits potentially linked to overall deposit and credit growth.

Another reason for the sector's underperformance could be the convergence of multiples over the past three to four years. Specifically, the valuation multiples of previously high-flying "corporate" private banks and PSU banks have risen due to improved performance, as evidenced by higher returns on assets (ROAs) and lower credit costs. Conversely, the multiples of former favourites have declined due to both macroeconomic factors (such as stable credit conditions) and microeconomic factors (specific to individual banks). This partial convergence in multiples also reflects:

-

Comparable returns on equity (ROE) across most covered banks;

-

A current lack of emphasis on the various underwriting capacities of banks, given the generally favourable credit conditions.

Another perspective is that the previous growth cycle was driven by consumption rather than capital expenditure (capex). Consequently, lenders supporting this consumption saw growth and valuation success. The current cycle, led by capex, may be causing a rerating of multiples to reflect these capex cycles and a decline in multiples for consumer lenders. Moreover, the RBI has been raising red flags in some form or the other with respect to unsecured loans – these are high margin loans for banks.

The key financial parameters to be evaluated for a Bank are:

-

Credit growth

-

Net Interest Margins (NIM)

-

Credit costs

The three aforementioned factors have been favourable for banks over the past few years. Moving forward, though, it appears to be very challenging to keep at least one of them from slipping.

The Credit Growth Challenge:

A nominal GDP growth rate of 11% makes credit growth of 14–15% manageable for a nation. However, because of the gradual RBI regulations and the fact that deposits have been growing more slowly than credit for some time, banks will need to work harder to attract deposits, which might entail raising deposit rates or decreasing at a slower rate. Aside from this, unsecured lending accounts for a large portion of credit growth, and the rules governing it are only becoming more stringent.

The NIM Challenge:

The banks might be compelled to increase their deposit rates to support deposits at a time of expected rate decline. NIMs would probably peak as a result of assets being valued lower and/or liabilities being valued higher. Furthermore, unsecured lending has historically been a high margin product for banks, though it is becoming harder to expand at a rapid rate.

The Credit Costs Challenge:

In certain areas, the regulator has voiced their unease about excessive unsecured lending. As a result of instances where borrowers from various institutions obtained multiple unsecured loans, the regulator has appropriately issued a warning. Even though we may have passed the peak of the credit cost cycle, there is still a chance that some of these expenses will increase, particularly if the rate of incremental growth in unsecured lending declines and impacts the ability of high-risk borrowers to make their loan payments.

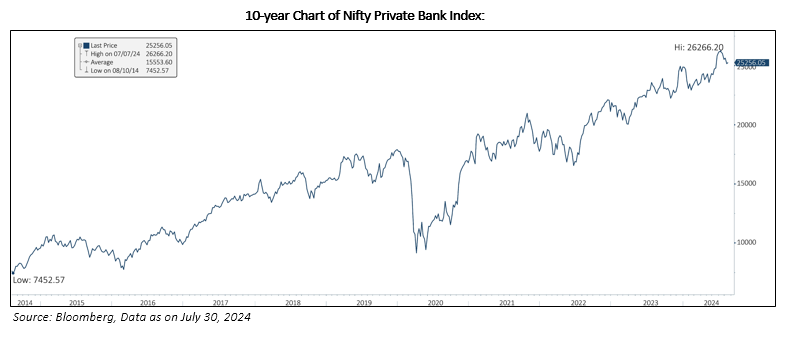

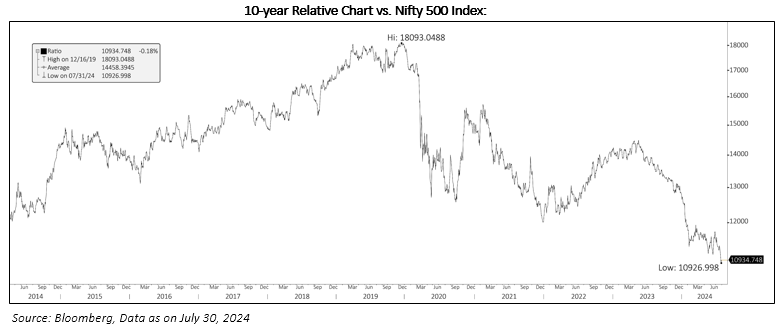

Interestingly, while the Nifty Private Bank Index is near all-time highs, its relative performance against the Nifty 500 Index is at a 10-year low, a rare phenomenon.

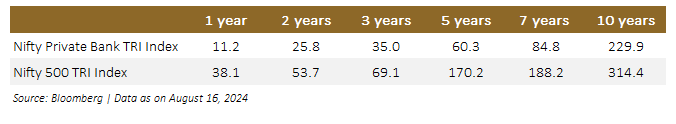

In terms of numbers, Absolute Returns (%) of the two indices are as follows:

In terms of numbers, CAGR (%) of the two indices are as follows:

These are indeed intriguing times. Only time will reveal whether this is the perfect point for a rebound or if further underperformance lies ahead.

Banks in the portfolio: Nil (Data as on July 31, 2024)

View and Stance:

In the last couple of months, we have seen volatility emerging from election results, then budget and now on the yen carry trade unwinding. A higher valuation and not so inspiring results season is also ensuring that the grip of the bulls is not that firm at least in the near term, in our view.

Nifty is trading at 20.1x one year forward EPS – a premium of 13% over the last 10 years’ average, but 12% cheaper than October’21 highs. This is primarily due to strong earnings delivery.

In terms of the cycle, India is in a bit of a goldilocks situation with strong macro growth, rising corporate earnings and a rate hike cycle almost coming to an end.

As per Bloomberg consensus, Nifty earnings are expected to report an annualized growth of ~14% over the next 2 years.

Overall, we remain positive on Indian markets, with market volatility providing an opportunity to add. We maintain an overweight stance on Domestic Cyclicals including Manufacturing, Industrials, Power, Defence, Railways, Pharma and Real Estate.

Alok Agarwal

Head – Quant & Portfolio Manager

Alchemy Capital Management Pvt. Ltd.

Disclaimer: Investments are subject to market risks, please read all product /strategy related documents carefully before investing.