Oct 2022

If you find this read interesting, share it on:

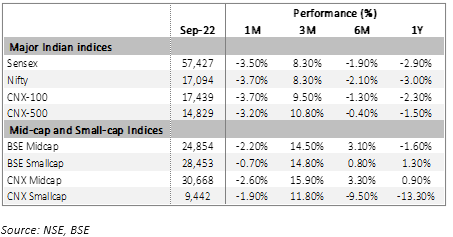

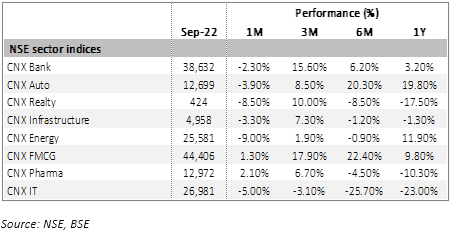

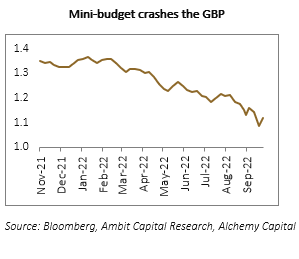

The Nifty corrected 3.7% in September 2022 after a strong 19% rally between 19-Jun 2022 and 15-Sep 2022. The sell-off was largely triggered by global factors like continuing tightening by the Fed and instability brought on by Britain’s mini-budget. We believe this noise could continue for 1-2 quarters, but the Indian market should remain strong beyond that. The tailwinds from strong domestic macro, resilient earnings and continued financial stability underpins our optimism. In the short term, however, we see the markets responding to some key events and trends – we list some of these in our blog this month.

Global Markets

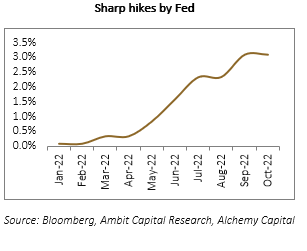

September 2022 month was dominated by global events. The US Fed announced a 75bps hike on 21-Sep 2022, with commentary that indicated continued tightening. This has raised the risk of a US recession and the markets turned understandably nervous. The mini-budget from the UK, effectively widening the fiscal deficit, sent stocks, bonds and currency into a tailspin – this was subsequently rolled back on 3-Oct 2022. The energy crisis in Europe shows no sign of resolution, forcing governments to provide fiscal support to beleaguered consumers as winter approaches. We believe that Indian equities have absorbed a large part of the global shock already – going forward, these may drive some short-term volatility but are unlikely to break the trajectory of the market.

We draw comfort from India’s resilience to the headwinds so far, but an extreme event puts that at risk. The worries around the state of some European banks are one such example, but we note that these are unsubstantiated rumours up until now.

Domestic Financial Markets

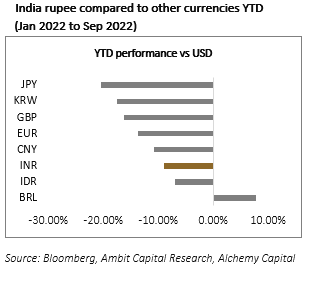

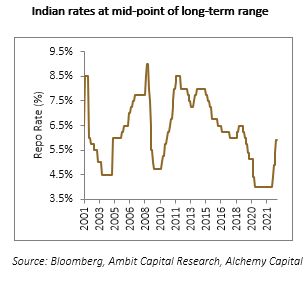

The Indian currency and money markets encountered their fair share of volatility too. The RBI raised rates by 50bps on 30-Sep 2022, though their tone seemed more benign for future hikes. The currency felt the impact of the global dollar rally and fell by 2.3% during the month. We do not see these impacting the medium-term outlook for equities. Despite the 190bps rise in the repo rate from the bottom, rates are still at the mid-point of the long-term range and unlikely to affect domestic demand or corporate balance sheets. The rupee weakness is also not alarming – it is outperforming other currencies, the current account deficit is lower than historic highs and the worst of the capital account pressure is probably done. Follow the links for more detailed discussions on the impact of interest rates and the currency on Indian equities in our previous blogs.

Aggregate Demand Trends

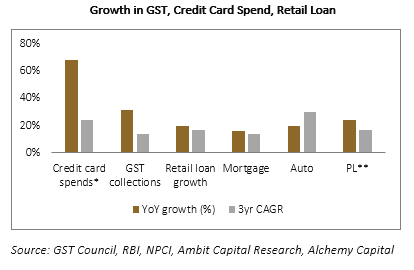

We see resilient demand as a key reason for being positive about the markets. The ongoing festival season should test that assumption, and we are closely watching the trends. The initial anecdotal feedback has been positive, with reports indicating a strong response to the initial sales by online shopping portals. Some hard data like credit card spend is supporting the thesis of strong demand. The next few weeks will reveal more and set the tone for the demand scenario over 2HFY23. The only weak spot could be mass segment demand, where consumers seem to be still suffering from the effects of high inflation, despite the recovery in employment levels.

Note: 1) Retail loans/Mortgage/Auto/PL numbers are as of Aug’22. 2) GST data as on end of Sep’22

*Credit spends/UPI merchant data till Apr’22-Sep’22. Sep'22 are Ambit estimates based on partial data given by the RBI | ** incl. other PL, loan against gold/jewellery, loan against securities, loan against FD and consumer durables etc.

2Q Earnings Season

We enter the 2Q earnings season and we are following some key trends as an indicator of the earnings trajectory for FY23/FY24

- Top-line growth, of course, will be the key factor. For consumer companies, we expect strong growth but we shall be following the numbers for industrials as well. Management commentary around the festival season demand and the outlook for 2HFY23 would be critical.

- The impact of the weakness in global commodities is important. The benefit may not be visible immediately in 2QFY23, as existing inventory could be written down. Management commentary would be crucial, on whether the companies enjoy the margin relief or choose to pass it back on to the consumers.

- Mainstream IT companies have underperformed calendar year 2022, due to high initial valuations and demand uncertainty as recession looms in the US. Commentary around their resilience would be keenly followed, and any positive surprises could see some relief for the sector. We aren’t holding our breaths though – we would rather wait for concrete evidence of the demand outlook than jump in too early.

- Asset quality trends from banks are critical to the broader markets, too. The risk-off strategies post-pandemic, combined with conservative provisioning, are leading to a very benign FY23. The sustainability of the trend is key to supporting this sector after the sharp rally in CY23. We are positive on medium-term NPL trends but remain watchful for any risks.

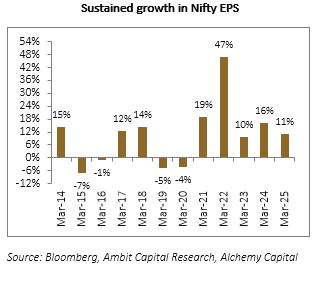

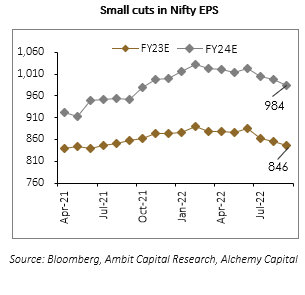

The earnings outlook for the market has stayed resilient and the Nifty EPS has held up well after some cuts in early 2QFY23. We see this continuing and, if demand holds up, the possibility of further upgrades to FY24 consensus.

Stay Invested

We would urge investors to avoid timing the market and stay invested to the extent of their strategic allocation to equities. Staggered inflows of lumpsum amounts do help de-risk, but should not be extended by more than 1-2 quarters, in our view. We continue to minimise cash and try to deploy fresh inflows generally within a month, to balance the needs for taking advantage of the volatility and not being exposed to cash drag.

Seshadri Sen

Head of Research

Alchemy Capital Management Pvt. Ltd.