Feb 2022

If you find this read interesting, share it on:

The FY23 Union Budget continued the government’s renewed focus on growth recovery that began last year. The preference for government capex over consumption stimuli was reinforced as the government stayed with its belief that this creates structural growth. The other notable feature was the conservative numbers, which we believe has multiple benefits.

We remain constructive on Indian equities and are increasingly confident on the growth recovery driving a sustained mid-teen market earnings growth over 2-3 years. Our key sector preferences are consumers, cyclicals (ex-commodities) and exporters, underpinned by our broad views on key macro indicators. We continue to focus on strong companies with market leadership and significant competitive advantage. Outside the new-age sectors, we prefer investing in companies with strong balance sheets, cash flows and strong-to-improving return ratios.

Budget takeaways

Capex push

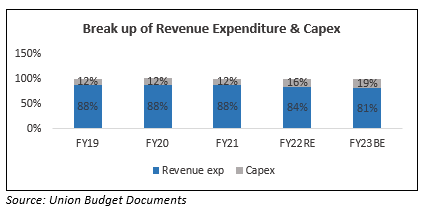

The government has accentuated its path of pushing public capex to stimulate the economy. Capital expenditure for FY23 is up 35.4% y/y (excluding Air India Recapitalisation in FY 22). Some of the components are one-off, but we are encouraged by the sharp increase in categories like road construction, which is achievable and has multiplier effects on growth. The capex push should kick off a virtuous cycle where we see a multi-year growth cycle for infrastructure and industrial companies, after a sustained period of struggle through the decade ending 2020.

Shifting balance of expenditure

The lack of a direct consumption stimulus is notable. The uneven recovery in FY22, skewed towards higher-income segments, had driven expectations that such a measure was forthcoming. We do not see this as an issue for multiple reasons:

- There is an indirect stimulus via the increased spending on roads and railways. These are labour-intensive sectors that create large employment opportunities for lower-income segments.

- The extension of the ECLGS* scheme should help SMEs get back on their feet in FY23. This should help in transmission of growth to a broader base than what we saw in FY22.

- Outside the budget, the real estate sector is recovering across the country. This, again, is an important sector for low-friction absorption of excess labour throughout the country.

- The recent wave of the Omicron variant of Covid-19 created minimal disruptions to normal life. If the pandemic does, indeed, peter out, the lack of lockdowns should also help in reducing the stress on lower-income segments. * Emergency Credit-linked Guarantee Scheme

We believe that the capex push is the optimum usage of the four-year window of higher fiscal deficit, as it creates more durable growth than direct consumption stimuli.

Conservative budgeting

The government has stuck to its fiscal consolidation path of reducing the deficit by 50bp in FY23. More importantly, the numbers are conservative on multiple fronts – GDP growth assumptions, tax buoyancy and disinvestment assumptions. The obvious benefit of this is that it increases the credibility of the exercise, an area in which India has decades of spotty performance. The other positive is that it eases pressure on the government machinery – optimistic targets lead to second-order issues like overzealous tax collection efforts, aggressive push for disinvestments, and so on. It is likely that the final deficit will undershoot by 8 to10%, but that is a cushion that gives the government breathing space.

Bond market stress

The bond market did not take the numbers well, with an ~20bp spike in bond yields since 31-Jan-22. We think the stress in the market should persist for some months as the market is squeezed from both ends.

- Supply is being constrained as M3 growth starts to normalise on the back of the RBI withdrawing stimulus and, possibly, challenges to foreign capital inflows on the back of the Fed tightening. Moreover, the RBI’s ability to conduct open market operations will be constrained by the need to tighten policy.

- This is being met by a sharp spike in demand – the borrowing calendar for 1HFY23 will be based on the budgeted amount and not capture the possible upsides to government revenue.

Economic outlook

Growth: We see a multi-year period of growth, propelled by the virtuous cycle kicked off by the post-pandemic stimuli. The next 3-5 years should see multiple engines of growth firing simultaneously. Capex should get kicked off by the government’s push starting FY22. Consumption is likely to accelerate as the growth becomes more broad-based from FY23. Exports are back after a long hiatus, helped by global growth, diversification of global supply chains and the government’s fiscal support to select industries.

Fiscal deficit: We see steady fiscal consolidation from FY23 onwards. India’s fiscal deficit is counter-cyclical with high growth as revenue buoyancy kicks in and spending is relatively inelastic. The government is likely to comfortably meet the FY26 target of 4.5% if growth remains elevated.

Interest rates: Stress on long-term bond yields should start to taper from late CY22 as growth kicks in and revenues overshoot budget estimates. On the other hand, short-term yields should continue their upward journey as the RBI moves towards a less accommodative monetary policy. We do not see higher interest rates as a challenge to growth – they will still be moderate compared to history and other demand drivers like capex and exports will continue to be in play.

Currency: The rupee should largely remain stable (against USD) through the next 2-3 years. The Fed tightening is a threat, but that should be offset by high growth, strong equity markets and some tightening from the RBI. Currency market collapses are often co-incidental with equity market stress in India – so this is a variable that we will continue to track closely.

Inflation: We have probably seen the worst of inflation. Global commodity inflation should cool off (even if prices go up) on a higher base and global monetary tightening. Supply-side challenges should also improve through the next 3-4 quarters as the impact of Covid-19 wanes throughout the world. We do not see a return to the 2019 levels of 2-3% but it should remain within the RBI’s tolerance band of 4-6%.

Seshadri Sen

Head of Research

Alchemy Capital Management Pvt. Ltd.