Apr 2022

If you find this read interesting, share it on:

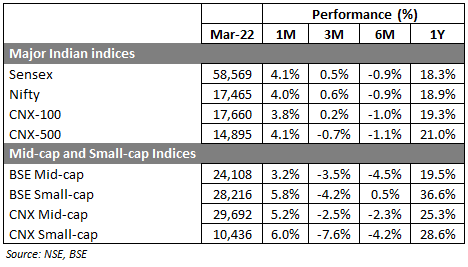

We see the end of a 4-6 month period when the market was disrupted by external factors – the Fed rate hike and the Ukraine war. The domestic economy should now take centre-stage: growth, opening-up, a strong agri recovery, and the capex cycle being the key drivers. Broader market returns are likely to moderate from the CY20/CY21 levels, but individual sectors would continue to present strong opportunities. We remain fully invested and are focusing on smaller sectors that lie outside the broader Nifty.

External risks diminished

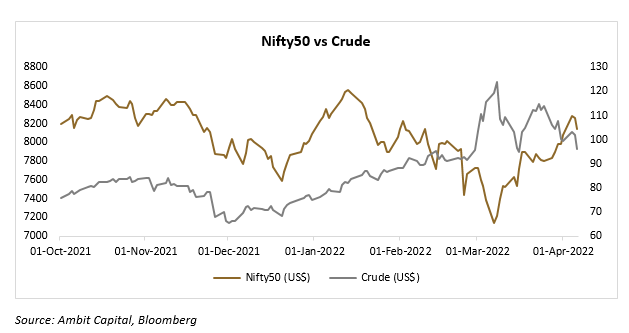

The Russia-Ukraine war has been distressingly long-drawn, resulting in a humanitarian disaster with large casualties and a refugee crisis. The contagion on the global economy, however, has been contained – as is evident in Brent crude falling 27% since the 7-Mar 2022 high and stabilising at the $100-110/bbl level in the recent past. Risks to supply-chain disruptions persist and are affecting multiple sectors and fuelling inflation. From the markets’ perspective, the worst of news-flow on the war seems to be over and it poses limited downside, going forward.

The impact of Fed hikes on equities is also minimal, in our view. It is now a known event and largely priced in. We maintain our earlier arguments that hikes, by themselves, do not pose a threat and some of India’s best bull runs have been accompanied by rising US rates. Of course, the risk is that we could be in for a spell of high inflation and low growth with the Fed’s actions pushing the Western world into recession. That is not our base case hypothesis, though it is a key monitorable.

A word on the market resilience. These external events triggered a $19bn net outflow via FPIs between Oct-21 to Mar-22 ($25bn from the secondary markets) – but the Nifty is down just 5% from the highs of 19-Oct-21. Near-term FPI outflows remain uncertain, but we think that the mere slowing of this selling will trigger a recovery in the market, as it indeed has in the last 3-4 weeks.

Domestic liquidity normalising

The RBI Monetary Policy Committee decision on Friday (8-Apr-22) signalled a definitive turn in India’s liquidity cycle. We do not see a cause for worry for the next 12 to 18 months. We believe that the economy should be able to absorb higher rates, which anyway would be well below long term peaks. The RBI decision, in some way, affirms it’s confidence in India’s economic recovery. Any negative impact on valuations would be more then offset by earnings upgrades that would stem from the strong macro recovery. Richly-valued companies with weak underlying earnings growth may, however, underperform in such a market.

4Q earnings outlook

The upcoming earning season will be the next event for the market.

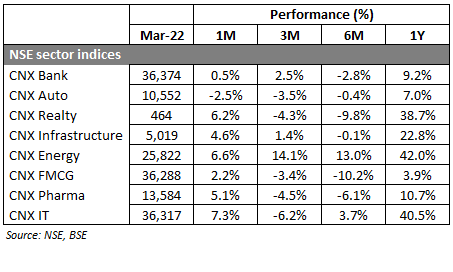

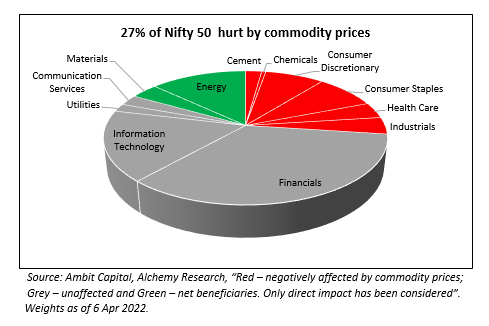

- Margins will be in focus, given the spike in commodity prices. As the chart given below shows, only a small share of the Nifty is vulnerable to high commodity prices: ~70% is neutral or is positively impacted. It is a similar picture for the broader indices. Having said that, we do see consumer companies facing margin pressure and, possibly, guiding to further headwinds in 1QFY23.

- Revenue growth should start to bounce back, especially due to a low base effect in 1HCY20. Sectors affected by the lockdown are likely to show the highest growth, though investors should focus on normalised numbers like 3y CAGR or seasonally adjusted sequential growth. Some sectors like autos continue to be affected by supply-chain issues. One-off margin shocks for manufacturing companies remain a key risk, given the recent volatility in commodity prices.

- Discretionary spends have started to recover, and we will track evidence of that in the earnings. The concurrent numbers (4QFY22 and 1QFY23) should be strong, but the medium-term outlook is the key – we believe that the cycle will last beyond the post-pandemic pop but will monitor the earnings and related management commentary.

Moderate returns for broad market

Strong fundamentals

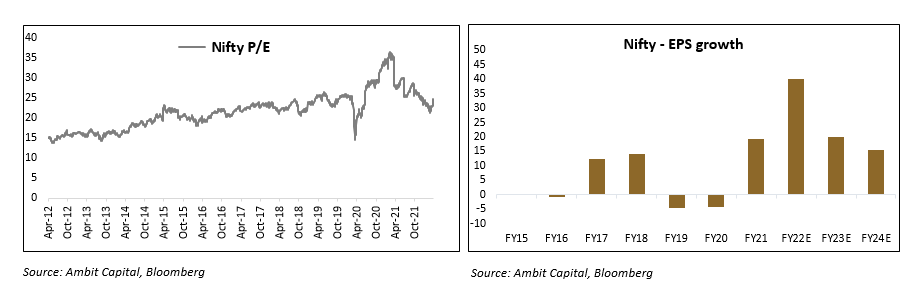

FY23 is likely to see strong fundamentals for the market. We expect a 2-3 year period of sustained mid-teen earnings growth for the Nifty – not seen for the last decade and a half. Moreover, this earnings growth is likely to be less concentrated among a top few companies and sectors, unlike in the latter half of the teens (2011-2020). This should provide a protection from sudden sell-offs and excessive downside risks over the next 12-18 months. It also implies that the breadth of market performance should be much stronger than it was in the previous decade.

High valuations

Valuations, however, are elevated. This will moderate returns to at or below the broad EPS growth – which is the basis for our expectations of muted returns for the overall market. Moreover, some key sectors like financials and autos face uncertainty of disruption by new age companies; this caps their overall valuation upside. We also sense this at a micro level – increasingly, we are relying more on earning growth for stock price upside rather than rerating candidates.

Seshadri Sen

Head of Research

Alchemy Capital Management Pvt. Ltd.