Nov 2023

If you find this read interesting, share it on:

Human beings have the privilege of acquiring knowledge and passing it on to the next generation and that is how all the different branches of knowledge have grown. Electronics, medicine etc did not evolve in one day, not by one person, nor in one lifetime. It required a couple of centuries to reach where we are today. Again and again, the revival of knowledge, of tradition happens. Tradition means it is an experience of millions of people over millions of years. In the same way contemporary yoga has been refined, reformed and rejuvenated many times over time.

In Chapter 4 of the Bhagavad Gita, Shri Krishna gives the paramparaa, (or the tradition), of the knowledge of the Gita. He says that he had revealed the same knowledge a long time ago to Vivasvaan. (Vivasvaan means the sun). The sun then gave this knowledge to Manu. Manu is the original ancestor and is considered to be the first human being from whom all humans originated, like Adam in the Bible. Hence humans are called Manushya. Manu then gave this knowledge to Ikshvaaku, who was the first king of the Solar dynasty or the “Suryavansh.” Whoever received this knowledge needed to be capable of communicating it to others. It was not enough that this person was just wise. We have always been interdependent on each other to learn and grow in our journeys thus communication was as important as knowledge.

By pointing out the heritage of Jnyaana Karma Sannyasa Yoga Shri Krishna constantly reminded Arjuna that this is not a brand-new teaching, it always was a way of life but was lost due to the passage of time.

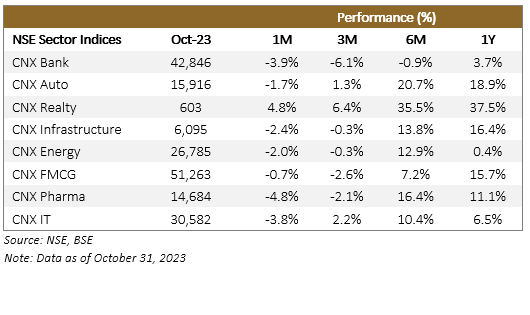

The Indian equity market has been experiencing capital outflows in recent times due to global factors such as multiple rate hikes by the Federal Reserve and other Advanced Economies central banks, a rise in US Treasury yields, rising commodity prices, and heightened geopolitical tensions due to the ongoing war between Russia and Ukraine and the Israel Gaza conflict.

Despite the market’s volatility, its resilience can be attributed to several factors. Firstly, there has been robust earnings growth in India. Secondly, there are structural elements that bolster the Indian growth narrative. Lastly, domestic flows have been on the rise but not as a big percentage of the overall NSE500 ownership.

While we discussed the first 2 reasons in our previous newsletters, let’s look at domestic flows in this month’s newsletter and NSE500 shareholding pattern.

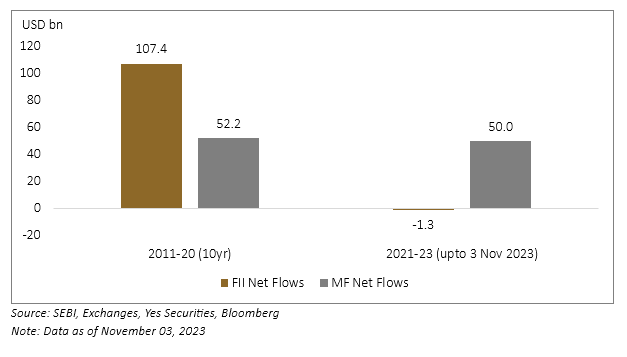

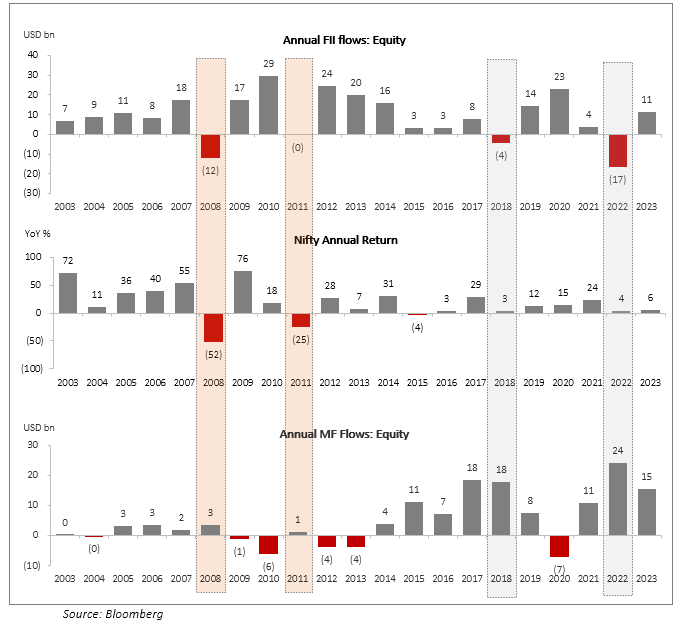

One will notice in the below chart that the colour of the flows have changed in the markets post 2020, the bigger contributor to the flows has been the domestic mutual fund flows vs FIIs in the period between 2011-2020.

INDIA – Changing Colours of Flows

India – Foreign flows vs Domestic Flows – What’s Driving Returns?

It’s interesting to see how the dynamics of the Indian markets have changed over the years. The increase in domestic buying post 2014 seems to have had a significant impact on market stability, even in the face of high FII outflows. This trend indicates the growing strength and resilience of the domestic market. It’s also noteworthy that despite the high outflows in 2022, the markets still managed to yield a return of 4%, thanks to the absorption by domestic funds.

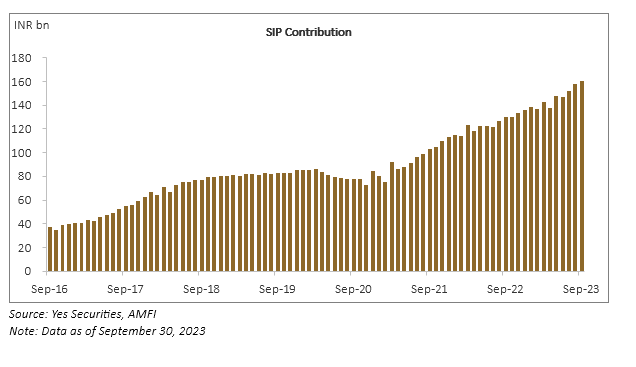

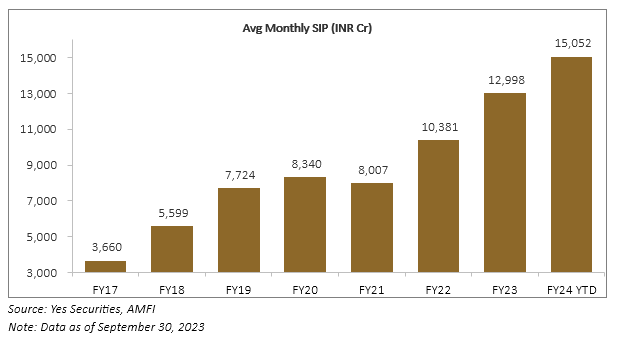

SIPs Continue to Drive Equity AUM

Equity market flows for DII’s have been driven by strong Systematic Investment Plans or SIP’s and the penetration is intensifying in lower-tier cities. Cancellation and bounce rates have seen a marked reduction over the past few months.

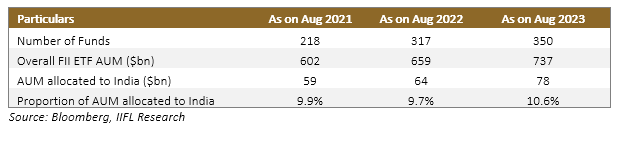

India Allocation Seen Increasing in FII ETF Funds

Over the last 3 years in spite of the FII outflows flows, India’s weightage in most foreign ETFs seems to have gone up, as India’s relative attractiveness to global funds keeps on improving.

The proportion of AUM allocated to India has increased by ~90 bps in the last one year.

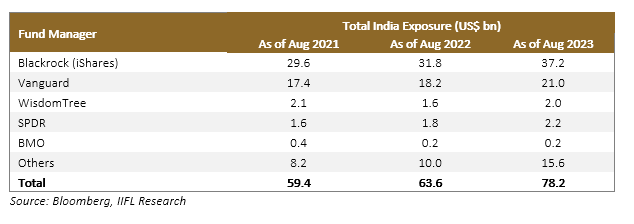

Key FII ETFs in India – major exposure coming from Blackrock and other smaller funds over the years.

Passive money flows into India has always remained resilient, as even during years of outflows, passive money has always kept coming in. With the increase in the weightage of India in global indices, passive money may continue to keep flowing in and we believe that it can see more flows from active funds as well.

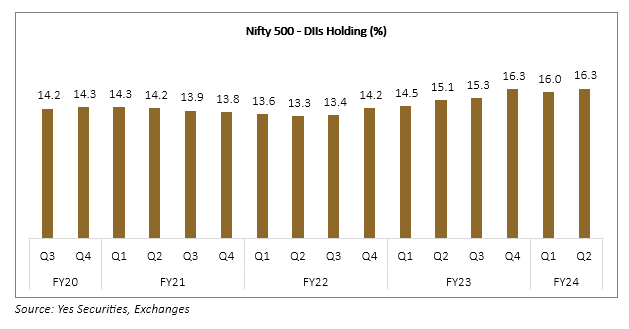

Market Ownership Remains Stable and Institutional in Nature

• Total institutional ownership has remained stable at around 34%-35%.

• Domestic Institutional Investors (DII) holding has increased from approximately 14% to around 16%.

• Foreign Institutional Investors (FII) holding has decreased from a peak of about 20% to around 19% now which could improve with an increase in allocation to India.

• Public holding has remained stable at around 8%-9%.

• The promoter group still holds the majority at almost ~55% of NSE 500 companies.

Indeed, the increased participation from both institutional investors and households has significantly contributed to the deepening and diversification of the markets. This, in turn, has enhanced the market’s ability to withstand higher volatility.

Moreover, the strong balance sheets of most corporates and banks, which have been deleveraging throughout the Quantitative Easing (QE) decade, have further bolstered the resilience of Indian markets against abrupt shocks.

This combination of factors has created a more robust and dynamic financial environment.

Getting back to Chapter 4, Shri Krishna clarified and elaborated upon key topics within Karma yoga. First, he gave the paramparaa or tradition of the teaching. He then revealed his nature as Ishvaraa, and explained the method by which he manifests as an Avataara. Finally, he explained how he responds in the exact manner that one approaches him.

In this chapter, Shri Krishna urges us to move to the next stage in this journey where we begin to lose the notion of doership “seeing inaction in action.” For example, when a doctor performs a surgery for a patient, the patient getting well or otherwise is not in the doctor’s hands, the doctor has merely done his job, which he must do sincerely and with very clean intentions.

Himani Shah

SVP – Investments & Research

Alchemy Capital Management Pvt. Ltd.

Disclaimer: Investments are subject to market risks, please read all product /strategy related documents carefully before investing.