May 2023

If you find this read interesting, share it on:

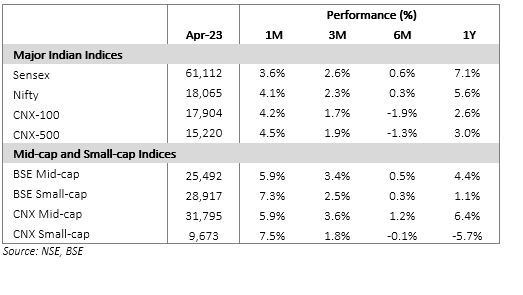

The Nifty rallied 4% in Apr-23 on the back of a confluence of positives. The earnings season was on track with no major negative surprises. Domestic financial conditions eased on the back of RBI’s surprise pause. Global tailwinds also helped and FPI flows added to the momentum. Reasonable valuations also acted as a catalyst, in our view.

The risks have not abated fully, however. We expect a choppy year and the key would be earnings resilience. Global volatility would also play a factor. We recommend staying invested and deploying fresh money over a short period of time.

Significant Positives in Apr-23

The earnings season has been off to a cautious start, but there were no major negative surprises. The data for the 22 companies (of Nifty) that have reported as of 2-May-23 show weak topline growth and some recovery in sequential margins. Y/y margins remain weak. Financials had a strong quarter but the outlook for FY24 is somewhat muted. We will review the earnings in our next month’s blog when all companies have reported.

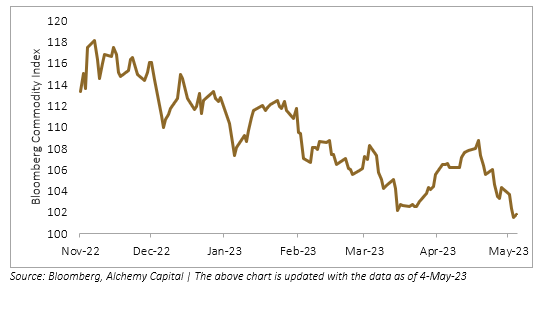

Commodity prices have corrected meaningfully. The Bloomberg Commodity Index is down 10%, led by a 22% correction in crude (since 31-Oct-22). This is hardly surprising as the world economy is steadily weakening on the back of sharp interest rate hikes in CY22. This has a positive impact on the markets – it is good for margins (especially for consumer companies) and should set off a disinflationary trend. The correction may not be one-way as we expect sporadic supply responses, but we do think that there is further scope for the commodities basket to fall.

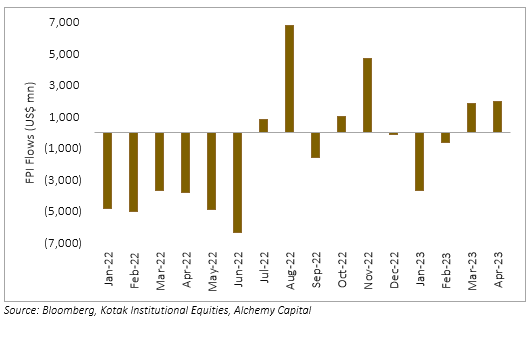

FPI flows were strong for a second consecutive month after >12m of sustained weakness. Flows in the derivative market were also robust in Apr-23. As interest rates peak, we expect a turnaround in FPI flows as the extreme risk aversion during rising rates starts to dissipate. However, in the absence of rate cuts in the near term (which is our base case), these flows should remain moderate and start to shoot up when rate cuts begin, probably in CY24.

The US banking crisis took another turn on 2-May-23 when JP Morgan announced its intention to buy the bank. This drove a relief rally in large US financials as the feared contagion effect from a bank failure was now averted. We think that the risks from the US banking system have largely abated with the stressed banks having been taken over without any significant damage to depositors. There is still some residual risk, but the worst part is probably over. The second-order impact –reduced credit availability driving a consumption slowdown – is likely to be muted now that bank failures are averted.

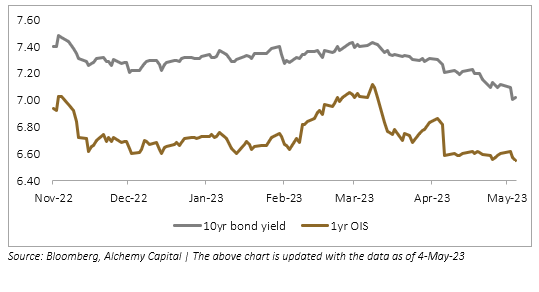

Domestic financial conditions, in our view, considerably eased in Apr-23. The RBI surprised markets by holding rates at its monetary policy committee meeting on 6-Apr-23 and guided that further rate hikes would only come if inflation spiked significantly from here. The RBI held its line on keeping liquidity tight, though. The markets reacted positively to this news with the 10-year bond yield falling 30bps to ~7%. Short term yields also declined with the 1-year OIS declining 24bps. (the yield drops pertain to the period 31-Mar-23 to 28-Apr-23).

Key Risks

We expect weakness in domestic consumption in FY24. In consumer discretionary, the post-Covid front-ending of demand seems to be finally impacting topline with a delayed impact. Mass segments seem to be still struggling from the effects of Covid and inflation – the expected recovery keeps getting delayed. The second-order impact could be that companies pass on commodity price benefits to gain market share. This puts the consensus FY24 EPSg of 15% at risk, which is largely dependent on margin recovery.

There is a small risk of a “hard landing” in the US – ie, the economy goes into a deep recession before interest rate cuts start. This, we believe, would trigger a market sell-off as earnings and valuations take a simultaneous hit. The correction would likely be short lived as rate cuts would quickly follow, but the pain would precede the gain. The probability of this is low, however.

Seshadri Sen

Head of Research

Alchemy Capital Management Pvt. Ltd.