Jan 2023

If you find this read interesting, share it on:

Dear Investors,

Happy New Year! Wish you a safe, healthy, and prosperous 2023.

There is much to be optimistic about in the coming 12 months. India’s macro should stabilise as rates peak, the currency steadies, and growth continues, albeit at a slower pace. Disinflation should help corporate margins bounce-back, and the continued momentum of mid-teen earnings growth should sustain. We expect a more broad-based rally next year, unlike the polarised markets that we witnessed in the last few months. Quality growth stocks with reasonable valuations should make a comeback. Markets are, however, also vulnerable to adverse, though unlikely, outcomes like a deep US recession or a hike in capital gains tax – we are monitoring these risks closely.

Macro Outlook – Stability and Growth

Growth and financial stability are the key macro variables that should define markets next year. Growth is expected to slow but remain resilient and prove the pessimists wrong. Financial conditions should improve as rate hikes pause and the pressure on the currency recedes.

Resilience to growth headwinds

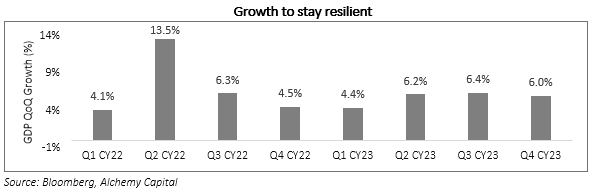

The sharp growth rebound in 2022 may not be sustained in CY23 due to multiple headwinds. The three main challenges that we see are:

- 2022 was the first post-Covid fully-functional year without any impact from lockdowns. This pushed up growth rates, not just from the low-base effect, but also because of a surge in “revenge spending”. A more normalised demand environment in 2023 could see an optical slowdown in growth.

- The global economy, led by the US and Europe, is expected to sharply decelerate on the back of higher interest rates. This is likely to impact export sectors which will face slower demand and probably pricing pressure, too.

- The government is likely to tighten the fiscal deficit in the Union Budget for FY24, which adds to the contractionary impulses.

The Bloomberg consensus predicts 6.0% GDP growth for FY24, but the forecast is down 50bps since May-22 and >10% of contributors have downgraded the forecast to <5.5%. We believe that growth should hold up at ~6%, despite the challenges. The consumption story in India is a multi-year trend driven by an upshift in per capita GDP and a change in aspirations. Moreover, other factors like “China + 1” and a capex recovery should help mitigate the headwinds. The downgrade trend could reverse as we advance through CY23.

Financial stability to improve

The financial markets were caught in a negative vortex in 2022. The sharp hikes by the Fed triggered a massive FII selloff and put pressure on the currency. The RBI managed to offset this by tactical use of reserves but also raised domestic rates significantly. Equity markets were also nervy, especially in 1HCY23, due to the FII selloff.

2023 should be much better. FII selling has abated, giving the RBI some headroom to manage the currency. The pressure on the current account deficit (CAD) from global commodity prices should also start to come off. Domestic interest rates should also peak; inflation is abating and the pressure from the external economy is also easing.

This could change if there is a hard landing in the Western world – we will discuss that later in this note.

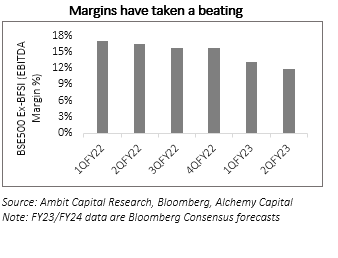

Top-line vs Margins

The decelerating economy would have its impact on corporate earnings. We expect topline growth to slow significantly as we enter CY23. This should, however, be offset by rising margins as the effects of commodity price inflation start to recede. Moreover, companies have taken price hikes through CY23 and that should start to help margins recover. EBITDA margins for BSE-500 (non-financials) had fallen 461bps y/y in 2QFY23, we expect that trend to start to reverse as we progress through CY23.

Our constructive thesis on Indian markets is partly based on earnings resilience. Consensus estimates still predict ~17% y/y growth for the Nifty in FY24 – this is largely based on the margin recovery story, in our view. Nervousness around slowing growth driving weak earnings is misplaced because of the scope for a margin bounce-back, we think.

Sector Rotation and Market Imbalance

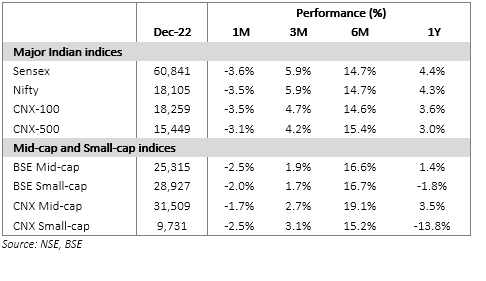

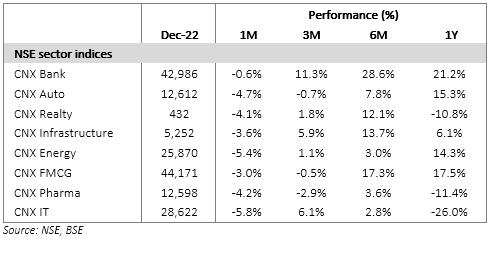

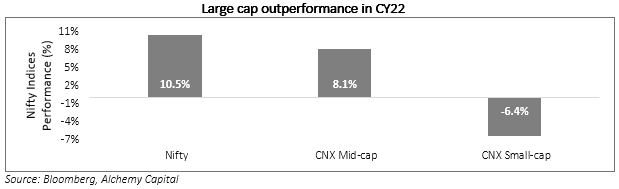

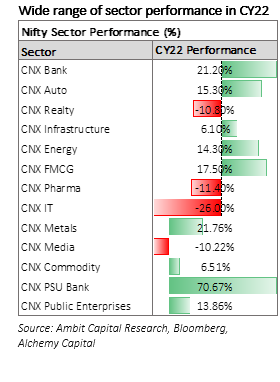

The narrower indices ended CY22 in the green, which was remarkable given the cumulative headwinds – rising rates, sticky inflation and large FII selling. This, however, hides the poor market breadth. Performance was largely related to a few sectors which rallied for relatively short periods. Moreover, mid- and small-cap indices underperformed the narrower Nifty.

We expect a broader market rally in CY23 for three reasons. First, worries around the macro should start to ease, especially around macroeconomic and financial market stability. This should reduce risk aversion and spur wider participation in the markets. Second, earnings growth for FY24 is expected to be more broad based than in FY23 (see chart below). Third, some sector-specific headwinds should start to ease, which should spur a broader rally.

Quality vs Value

Value stocks made a comeback in CY22, the first time in five years. We believe that this outperformance is short-lived and that quality will come back once the pockets of egregious under-valuation have been re-rated. The medium-term theme for the post-Covid Indian markets is earnings compounding – our preference is for stocks that meet this criterion. Of course, heavily over-valued stocks may still struggle. Our belief is that GARP with a quality overlay should lead the market in CY23.

Key Risks

A hard landing in the West

The base case assumption is that the Fed’s aggressive rate hikes will, at worst, cause a shallow recession in Europe and the US. If, however, the growth impact is deeper, the markets could be vulnerable to a large drawdown. This would trigger both an earnings and valuation correction and India, despite the strong domestic economy, would not be immune. Central banks would probably respond quickly with rate cuts to ensure that the market correction is short-lived, but the bad news would come first. This is the biggest risk that we are monitoring from the perspective of India’s equity markets.

Budget and capital gains tax

The Union Budget of FY24, slated for 1-Feb-23, will be the next important event. The long-term nature of economic policy has reduced the direct importance of the budget, but it still will be an important marker of the government’s approach in the run-up to the general elections of 2024.

There have been some news reports of a possible change to the capital gains tax(CGT), probably with the objective of harmonising rates across asset classes. We believe that minor tinkering (like increasing the threshold for short term CGT from one year) would have a transient impact on the markets. A drastic effective hike would, however, be a strong negative and could provoke a sell-off – as it did in 2018 when CGT was re-introduced.

China opening-up

China has recently lifted its harsh Covid restrictions, and the economy is gradually opening up. This poses multiple threats for the markets – resumption of commodity price inflation, the concentration of emerging market flows into the country (at the cost of other EMs like India) and a disruption of the supply chain diversification benefits. In our view there are, however, offsetting benefits. Supply chain bottlenecks should ease, helping growth and margins for manufacturing sectors. The China recovery should also be an offset to recessions in the western economy, helping global growth. And “China+1” is a long-term trend and is unlikely to be significantly disrupted by the economy opening up.

We believe that a full-fledged China recovery is a net benefit to the economy and markets.

Seshadri Sen

Head of Research

Alchemy Capital Management Pvt. Ltd.