Get Familiar With Taxation Of AIFs In India

Alternative Investment Funds (AIFs) have emerged as promising investment opportunities beyond traditional assets for investors in India. They enable high-net-worth individuals (HNIs) to diversify their investment portfolios. While AIFs provide the potential for higher returns, investors must also be aware of the tax implications associated with these investments. They play an important role in deciding which category of AIF to invest in.

In this blog, we will delve into the taxation of AIFs in India, helping you understand how these unique investment vehicles are taxed and the key considerations for investors. Before diving into Taxation of Alternative Investment Funds (AIFs), let's briefly recap what AIFs are.

AIFs are a distinct category of investment funds that differ from traditional investment options. They are designed to employ a wide range of investment strategies, including private equity, hedge funds, real estate, infrastructure, venture capital, and more. AIFs are typically managed by professional fund managers and cater to accredited or sophisticated investors, such as institutions, pension funds, and high-net-worth individuals.

Taxation of Alternative Investment Funds (Category-Wise)

Each category of AIF is a different investment vehicle therefore it is taxed differently. As such, it is important for investors to understand the income tax implications of AIFs. Income (other than business income) from Category I and II is taxed in the hand of the investor as per their applicable tax rate whereas for Category III income is tax-free in the hands of the investor because Category III AIFs have not been accorded a pass-through status and as such onus to pay the tax lies with the fund. Let’s take a closer look at the tax regulations associated with AIFs.

Category I and II AIFs:

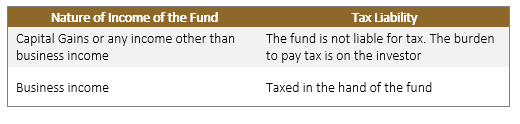

The Finance Act of 2015 introduced a special taxation regime under which Category I and II AIFs have been granted a pass-through status. Pass-through means that the income generated by the fund will be taxed in the hands of the investor and not at the fund level. Here, the tax liability on the income generated from the investment is borne by the investor. The fund is exempt from all tax obligations on the investment income or capital gain however, if the income generated by the fund is treated as business income, then the same is taxed in the hands of the fund. The below table will help to understand the tax structure better:

1. Long-Term Capital Gains (LTCG):

Investments held for more than one year in Category I and II AIFs are classified as long-term capital gains and accordingly taxed as per the rate applicable to long-term capital gain tax. Long-term capital gains on listed shares are typically taxable at the rate of 10% and on unlisted shares and other assets at the rate of 20%.

2. Short-Term Capital Gains (STCG):

Short-term capital gains from Category I and II AIFs are usually taxed at the applicable short-term capital gains tax rate based on the investor's tax bracket. Generally speaking, short-term capital gains are taxable at the rate of 15%.

3. Dividend Income:

Dividends from AIFs are taxable as per the investor’s tax slab.

4. Interest Income:

Any interest income earned through Category I and II AIFs is taxable as per the investor’s tax slab.

The above rates are prescribed under the Income Tax Act. It may be replaced by rates agreed to by the two countries in the Double Taxation Avoidance Agreements (DTAAs) if those provisions are beneficial for the investor. In addition, if any income apart from business income is distributed by Category I and II AIF to its investors, it shall be subjected to a withholding tax at the rate of 10% for resident investors and non-resident investors, the withholding tax rates shall be either as provided under the Act or DTAA whichever is beneficial.

Category III AIFs:

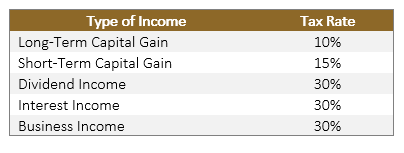

Under this category, any income whether investment income/ capital gain or business income is taxed in the hand of the fund. The pass-through tax regime has not been extended to Category III AIFs. The tax of four types of income is borne by the AIF that too at different rates. Below is the summary of taxation applicable to Category III AIFs:

Conclusion

Alternative Investment Funds (AIFs) have carved a niche for themselves in the Indian investment landscape, offering opportunities for diversification and potentially higher returns. However, understanding the taxation of AIFs is essential for investors to make informed decisions and optimize their tax strategies.

As the tax mechanism followed by AIFs varies depending on the category invested in, investors must carefully consider their investment goals and risk tolerance when choosing the right AIF for their portfolio. Seeking professional guidance and staying compliant with tax regulations are key steps in making the most of your AIF investments while managing your tax liability effectively.

Invest in Category III Alternative Investment Funds

Here is a glimpse into our Category III Alternative Investment Funds:

Alchemy Leaders of Tomorrow:

Alchemy Leaders of Tomorrow endeavors to focus on companies showing the best traits of adaptability to the new economic normal, driven by innovation & ingenuity. It is a sector-agnostic, multicap fund that aims to generate long-term capital appreciation by investing in (i) listed Indian equities, (ii) Private Investment in Public Equity (“PIPES”) on listed Indian equities, and (iii) IPO and pre-IPO opportunities. A concentrated fund generally comprises +/- 15 stock ideas.

Alchemy Long Term Ventures Fund:

Alchemy Long Term Ventures Fund endeavors to generate long-term capital appreciation by investing in (a) listed equities with a primary focus on small-cap; (b) IPO (anchor book) opportunities; (c) Pre-IPO / unlisted securities; and (d) such other securities/instruments as permitted under Regulations and Applicable Laws. The Fund will primarily focus on investments in small cap companies with up to 50% (Fifty Percent) or such other higher percentage as may be decided by the Investment Manager in accordance with Applicable Laws.

For more details, please connect with us at contactus@alchemycapital.com or click here

This blog is for informational purposes only and should not be considered as an offer or solicitation to buy or sell any securities or make any investments. We recommend readers to take independent advice before taking any investment decisions. Please refer to our Disclaimer and Disclosures for more details.